Asia-Pacific logistics rents hold steady in 2025 as caution sets the tone

3 minutes to read

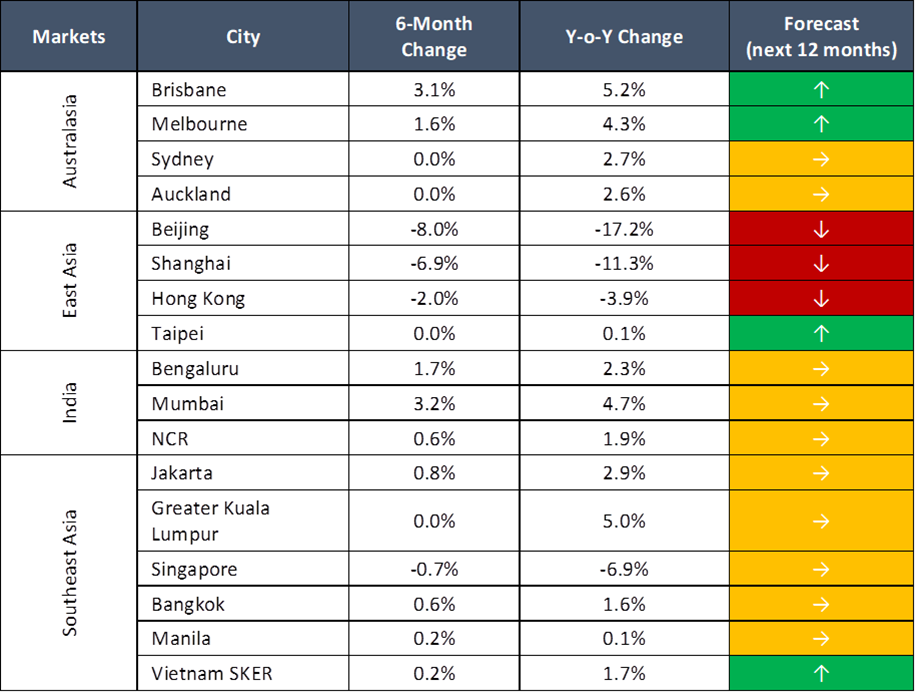

The logistics property space in Asia-Pacific showed signs of a cautious slowdown in the first half of 2025. Regional rents dipped slightly, down 0.4% year-on-year, as businesses weighed their options in the face of trade uncertainty and broader economic headwinds. While the headline numbers appear stable, distinct stories play out across different markets.

Here’s a closer look at the key findings from our Logistics Highlights H1 2025 report

Australasia: Growth loses pace

Australia, and Brisbane in particular, held onto the region’s top rental growth, with a 5% year-on-year rise in H1 2025. That said, the city’s momentum didn't last. Vacancies have crept above long-term averages, and landlords are offering more incentives to secure tenants for new warehouses. These incentives reached 16.5% across Australasia and were even higher in Melbourne and Sydney. Net effective rents slipped by 1.8% as a result.

Looking ahead, with less new supply expected after 2025 and the economy showing some signs of recovery, the market could find some balance. For now, though, caution rules as developers and tenants wait for clearer signals.

Southeast Asia: Holding the line

Emerging Southeast Asia’s logistics rents rose 1.9% from a year ago, but that was mostly flat compared with the last six months. Despite facing some of the region’s heaviest tariffs, demand remained steady. Businesses are increasingly exploring “China+N” strategies, spreading logistics and manufacturing across different countries to manage risks. Vietnamese provinces such as Binh Duong and Long An saw steady demand for Grade A warehouses, including a major deal topping 140,000sqm from an e-commerce newcomer. In Singapore, conditions held firm, but occupiers were wary, leading to a dip in rental deals after a wave of new supply hit the market.

East Asia: Pressure from oversupply

The logistics markets in Beijing and Shanghai felt the weight of new supply in H1 2025, with combined stock rising to about 20 million sqm. Vacancy rates climbed to 27.3%, leading landlords to get aggressive with pricing and incentives. Rental declines slowed a bit in Shanghai and may narrow further, but Beijing is still under pressure with another 2 million sqm to be delivered by year-end. In Hong Kong, leasing continued at a slow pace and more new space entering the pipeline suggests rents will remain subdued for the time being.

India: Opportunities on the upswing

India was the clear outlier in the region this year. Despite higher vacancy in the country’s main logistics hubs, rents climbed 3.4%, accelerating from the previous half-year. Manufacturing demand was the main driver, with more companies shifting operations to India in response to tariffs and changing supply chain needs. India’s S&P Purchasing Managers' Index reached a 14-month high in June, reflecting solid confidence. Third-party logistics and e-commerce operators were active, indicating that a new phase of growth could be ahead if current trends hold.

Outlook

The relative stability seen so far may partly reflect businesses bringing forward shipments ahead of tariff deadlines. As the year progresses, companies will likely review their logistics strategies closely, looking to manage costs but remain nimble enough to seize opportunities. Market participants across Asia-Pacific will likely keep their guard up for the rest of 2025, with a cautious approach shaping new supply and occupier decisions.

Read the full report here.