Investors are overlooking Africa's investment opportunities

The case for investment across the continent is compelling, but too many investors risk missing out on the multitude of opportunities on offer.

3 minutes to read

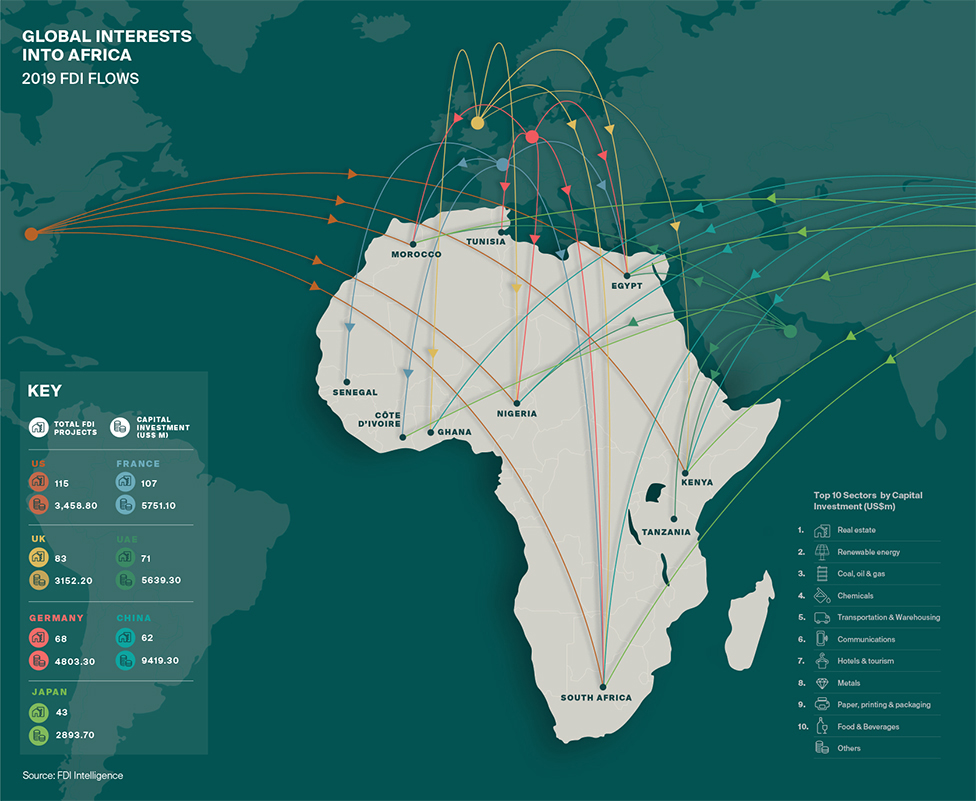

Despite accounting for around 17% of the world’s population, Africa attracted less than 3% of global foreign direct investment (FDI) in 2019, according to UNCTAD.

A recent survey published by Standard Chartered bank, representing US$50 trillion of investment, found that only 3% of the assets under management were located in Africa. However, of those respondents already invested in the continent, 93% said they wanted to increase their exposure, while more than 50% said their investments had performed as well or better than those in the developed world.

“The perception of heightened environmental and social risk in emerging markets is just that: a perception. The reality on the ground tells a different story,” writes Amit Puri, the bank’s Global Head of Environmental and Social Risk Management.

John Félicité, Director for Africa at Ocorian, which offers fund administration, corporate, fiduciary and capital markets services, agrees. “Among the barriers to progress and attracting fresh FDI is a misconceived perception of risk.

“There are of course genuine concerns to be had, but due diligence is key. Foreign investors entering Africa for the first time can mitigate risks and capitalise on areas of high growth potential by partnering with the right professionals on the ground.”

Adrian Mayer, head of law firm Charles Russell Speechlys’ Africa group, believes there is plenty of potential for those prepared to do their research. “I am seeing an encouraging number of clients looking at investment opportunities and deploying funds across the continent,” he says. Sectors of particular interest include renewable energy, secondary agriculture (see page 22) and real estate.

Although renewables are a good business proposition in their own right, Mayer notes they also tie in well with the UN Sustainable Development Goal (SDG) 7 – affordable and clean energy, which Standard Chartered estimates represents a US$4.2 trillion opportunity for private investors. “Many investors will only put monies to work in Africa if done so in accordance with the Sustainability Framework of the IFC (part of the World Bank), which is aligned with the UN SDGs,” he says.

Fundamentals for growth

Areas such as banking, telecommunications and infrastructure also have significant scope to grow, points out Félicité. “The long-term fundamentals for economic growth are strong. Despite the pandemic pushing the continent back into a recession, its growing, youthful population still contrasts sharply with the ageing populations of most other regions.

“The continent currently boasts the largest share of adults with mobile money accounts in the world, and with almost 60% of its population under the age of 25, tech adoption and the fintech space will continue to expand.”

A common criticism levelled at Africa is that too much of its GDP is based on extractive commodity markets, with not enough of the secondary processing and manufacturing capacity that powered Asia’s economic growth. Nevertheless, a study from Groningen University, cited by The Economist magazine, shows encouraging signs of growth.

In real terms, output is up by 91% since 2000, with the share of workers involved in the manufacturing sector in sub-Saharan Africa rising from 7.2% in 2010 to 8.4%. And, as venture capitalist Vusi Thembekwayo points out on page 4, the implementation of the African Continental Free Trade Area should provide a further boost to growth. Africa awaits.