The Rural Update: Carbon credit integrity

Your weekly dose of news, views and insight from Knight Frank on the world of farming, food and landownership.

8 minutes to read

Viewpoint

A new report that finds issues with some of the world’s biggest voluntary carbon market (VCM) offsetting projects should provide a boost for the UK’s high-integrity carbon credit market model. Although lacking in scale, high-integrity credits, such as the 8,000 recently sold by Oxygen Conservation to law firm Burges Salmon at £125 each, offer far higher levels of transparency and measurability than most of the mega projects in the Global South that currently dominate the VCM. If the government could finally add a soil-carbon code to its existing woodland and peatland codes, the opportunities would be far greater.

Sign up to receive this newsletter and other Knight Frank research directly in your inbox

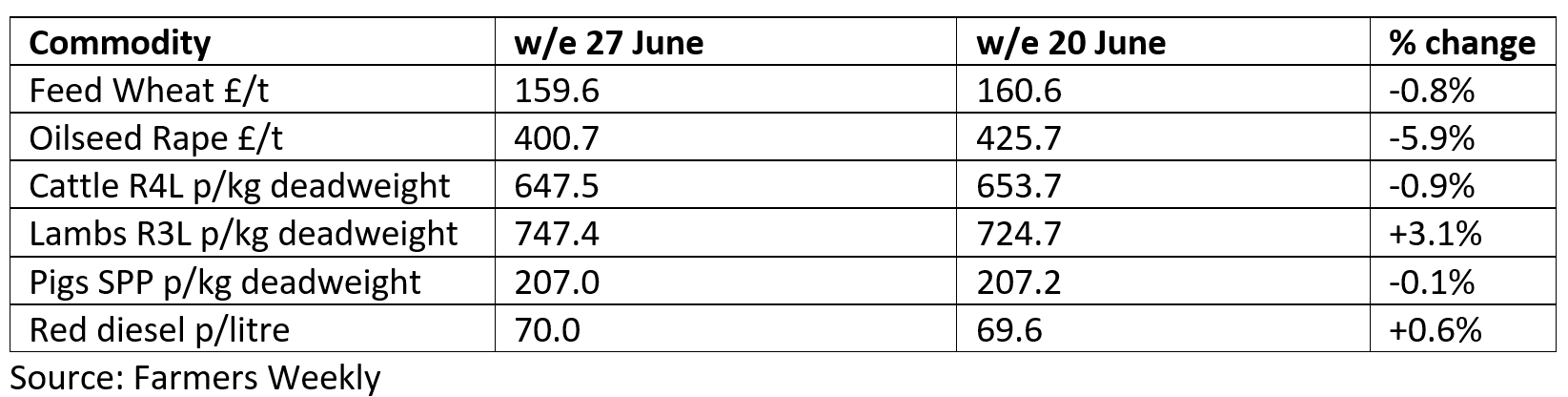

Commodity Markets

Barley goes early

Warm weather meant combines were deep into the English barley crop before the end of June, a much earlier start than usual. Prices dropped slightly on the week to £143/t, about 6p/t lower than this time last year. Yields are predicted to be 10% lower than in 2024, with some quality issues expected for malting barley.

Oil prices back down

Meanwhile, the ceasefire between Israel and Iran seems to have taken the heat out of global crude oil and oilseeds markets. Brent Crude started the week at just below US$68/barrel, while oilseed rape is down almost 6% on the week. The oil cartel OPEC+, led by Saudi Arabia, is expected to announce a further hike in output at its next meeting on July 6, which is putting further pressure on prices. Although it sounds counterintuitive to want prices to fall, Saudi Arabia, with its huge reserves and relatively low drilling costs, can use lower prices to exert more control over the market. The number of active higher-cost US rigs, for example, is falling as prices dip.

The headline

Carbon credit scrutiny

A new report has raised questions about millions of tonnes of carbon credits sold on the voluntary carbon market (VCM) to corporates and other organisations looking to offset their greenhouse gas emissions.

Built to Fail, an analysis of 47 of the world’s 100 largest VCM projects by advocacy group Corporate Accountability, identifies almost 48 million “problematic” offset credits from 43 projects that were retired last year, accounting for 80% of total credits.

The study rates credits “problematic” for a number of reasons, including the likelihood that they will fail to deliver the promised reduction in emissions, lack of permanence and over- issuance of credits.

Only four of the projects studied had a higher than “moderate” likelihood of achieving 1 tonne of CO₂e avoidance or removal.

Forestry and land use projects (23) and renewable energy projects (15) were among the most utilised “problematic” projects in 2024, but household device projects (4) and chemical processes/industrial manufacturing projects (1) were also “problematic”.

Over 90% of the “problematic” projects were in the Global South, the report notes.

News in brief

Family farm tax challenge

A group of farmers and businesses has instructed law firm Collyer Bristow to seek permission from the High Court to launch a judicial review of the government’s decision to scrap 100% agricultural property relief on farm businesses. They claim a lack of consultation prior to the announcement in last autumn’s budget has led to “flawed” policy. The CLA has published a constituency-by-constituency list of potential job losses and economic damage if the IHT reforms go ahead.

Trade strategy under fire

The government’s newly launched trade strategy has been criticised for not doing enough to protect the interests of farmers and the environment. Although the document commits to maintaining existing food safety and animal welfare standards, and the use of quotas or other safeguards when different production methods overseas create competitive imbalances, it falls short of legally enshrining minimum standards for agri-food imports.

Fruit and veg fall

There are also concerns that the strategy does not address the UK’s diminishing horticultural self-sufficiency. New figures reveal that while home production of vegetables increased by 2.3% to 2.4 million tonnes last year, imports jumped almost 6% to 2.2 million tonnes. It was a similar pattern for fruit. UK fruit growers now account for just 15% of the country’s consumption.

NI Nature Scheme

Farmers in Northern Ireland can now apply to the province’s Farming with Nature Transition Scheme to help fund more nature-friendly farming practices. Up to £9,500 per business is available to cover five key actions: planting new hedgerows, creation of riparian buffer strips, farmland tree planting, retention of winter stubble and multi-species winter cover crops. Applications close on 4 August.

National Trust carbon plan

The National Trust’s first climate transition plan aspires to use the 250,000 ha of land that it owns, including 200,000 ha of tenanted farmland, to help halve its absolute carbon footprint by 2030. By working with its tenants to change their farming practices, the charity hopes that its farmland will capture more carbon than it emits and avoid the need to buy controversial carbon offsets (see lead story).

Biosecurity investment

The government has committed £1 billion to a new National Biosecurity Centre in Surrey that it says will enhance the UK’s detection, surveillance and control capabilities for high-risk animal diseases such as avian influenza, foot and mouth disease and African swine fever. Approximately 60% of all known human infectious diseases can be transmitted from animals, while disease outbreaks can cost the agricultural sector many billions.

PIB attacked. Again

The Planning and Infrastructure Bill, whose environmental credentials came in for more criticism during its second reading in the House of Lords last week, has now been attacked by the House of Commons Animal Sentience Committee. The committee complained that while the bill included mitigation measures for the general impact on wildlife, it does not mention the welfare of individual sentient animals affected by developments.

New Surrey wildlife reserve

Natural England has just announced that the Wealden Heaths National Nature Reserve, which includes the Devil’s Punchbowl, will be the ninth out of 25 National Nature Reserves to be created or extended to mark the accession of King Charles to the throne. The new reserve is a collaboration between Natural England, the RSPB, the National Trust, Surrey Wildlife Trust, Hampton Estate, the Amphibian and Reptile Conservation Trust, Waverley Borough Council, Surrey County Council and Forestry England, with support from the Surrey Hills National Landscape.

GL45 refusal explained

Defra has just published its reasons for refusing to extend general licence 45 (GL45), which allowed the release of pheasants and red-legged partridges in Special Protected Areas (SPAs) or within 500m of their boundaries. The risk of avian flu spreading to internationally protected birds in SPAs is too high, it claims. Affected shoots will now have to apply for individual licences.

The Rural Report SS 25 – Out now

The Spring Summer 2025 edition of The Rural Report, Knight Frank’s flagship publication for rural businesses, which looks in more detail at many of the issues discussed in The Rural Update, is out now. The new report includes the latest news, research and insights from Knight Frank’s rural property experts, as well as thought-provoking contributions from some of Britain’s most iconic estates.

Available online and in print, you can click here to access the full report.

Properties of the week

Gloucestershire glory

This week we’re staying in the Cotswolds to visit Ashley Marsh Farm, near Tetbury. The 238-acre ring-fenced arable and grass farm is centred around an immaculately converted five-bed stone barn and includes 40,000 sq ft of modern agricultural buildings and a two-bed cottage. The guide price is £6.35 million. A four-bed stone house with 52 acres of land and an off-lying 64-acre block of arable land are also available by separate negotiation. Please contact Will Oakes for more information.

Historic Kent estate home to rent

For anybody looking to sample estate living without making a long-term commitment, Knight Frank’s Rural Consultancy team in Kent has an intriguing option on offer. Newhouse at Mersham, near Ashford, which was once home to The Countess Mountbatten of Burma and Lord Brabourne, is part of the idyllic 2,700-acre Hatch Park Estate. Now available to rent, the nine-bed period property costs £7,995 a month. For more information, please contact the team’s Katie Bundle.

Discover more of the farms and estates on the market with Knight Frank

Property markets

Development land Q1 2025 – Market falls

The value of greenfield development land fell by 2% in the first quarter of the year. Urban brownfield sites, however, lost 5% of their value over the same period, according to the Knight Frank Residential Development Index.

Farmland Q1 2025 – Values resilient

The Knight Frank Farmland Index, which tracks the average price of bare agricultural land across England and Wales, showed a marginal drop of 1% in the first quarter of 2025 to £9,072/acre. This follows a similar small decline in the final three months of 2024, bringing the annual fall to just 1.9%.

Country houses Q1 2025 – Mixed picture

The average price of desirable homes in the countryside slipped by just 0.3% in the first quarter of the year, according to the Knight Frank Prime Country House Index. Over the past 12 months, values have fallen by 1.6%.