Global property markets recalibrating: prime prices rise in 2023

We take a look at what lies ahead for the world’s top residential markets and the trends set to shape their performance.

3 minutes to read

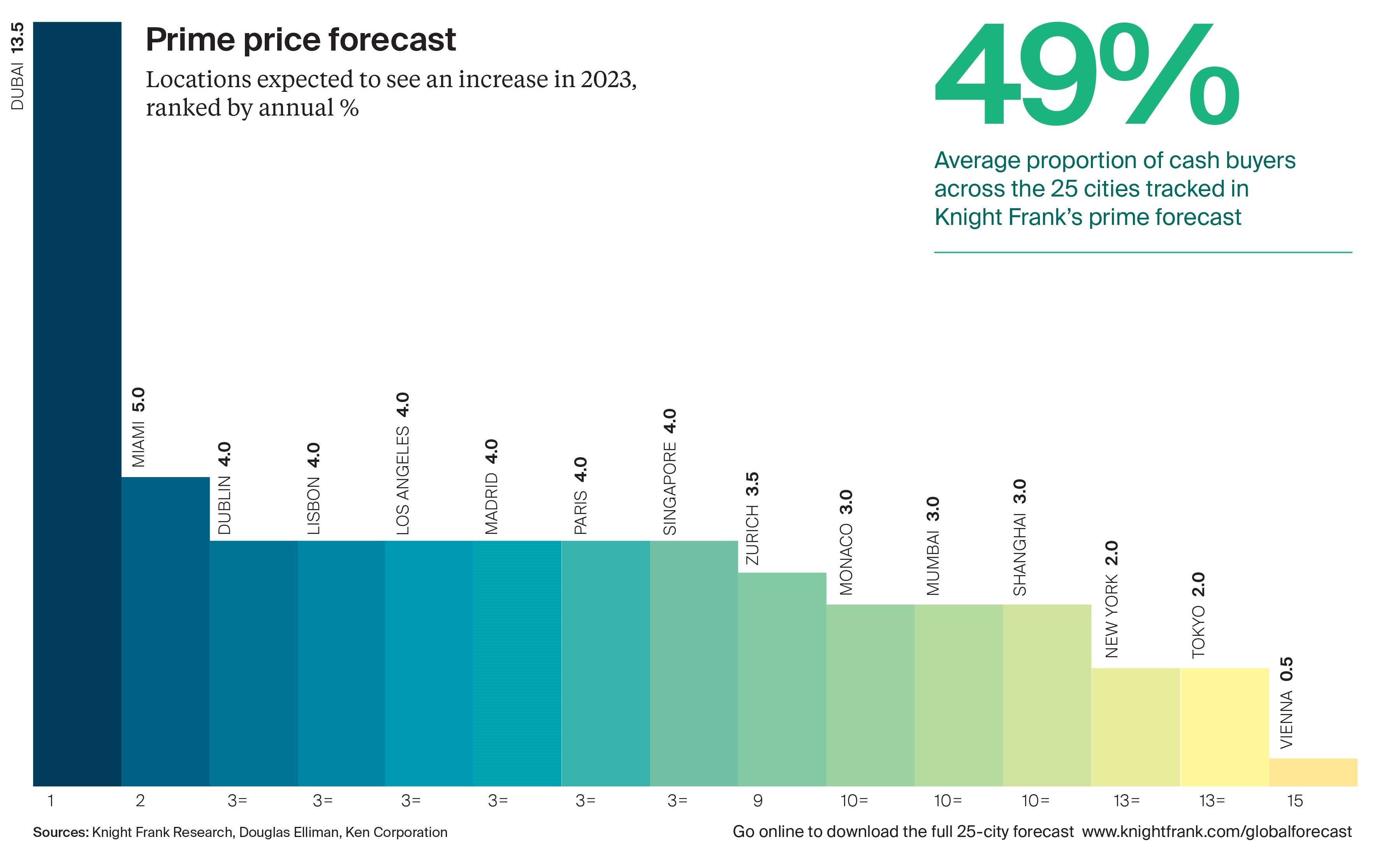

The tide is turning, and property markets are recalibrating, as homeowners take stock of the changing macroeconomic landscape. Across the 25 cities tracked, Knight Frank’s global research network now expects prime prices to rise by 2% on average in 2023, down only marginally from the 2.7% we predicted in mid-2022.

The slowdown will be far from uniform. Some cities will see annual price growth shift into single digits, while some will see it move into negative territory. Yet 15 of the 25 cities tracked still expect prime prices to increase in 2023, down from 18 a year ago.

Dubai leads the forecast with prime prices forecast to climb 13.5% in 2023, its relative affordability, broadening global appeal and accessibility a key draw.

The US cities of Miami and Los Angeles occupy second and joint third spots respectively, with both markets still benefiting from the post-pandemic reassessment of lifestyles.

Six of the top ten positions are held by European cities with domestic safe-haven capital flight and strong overseas demand due to the weak euro proving key market drivers.

Property a safe asset class

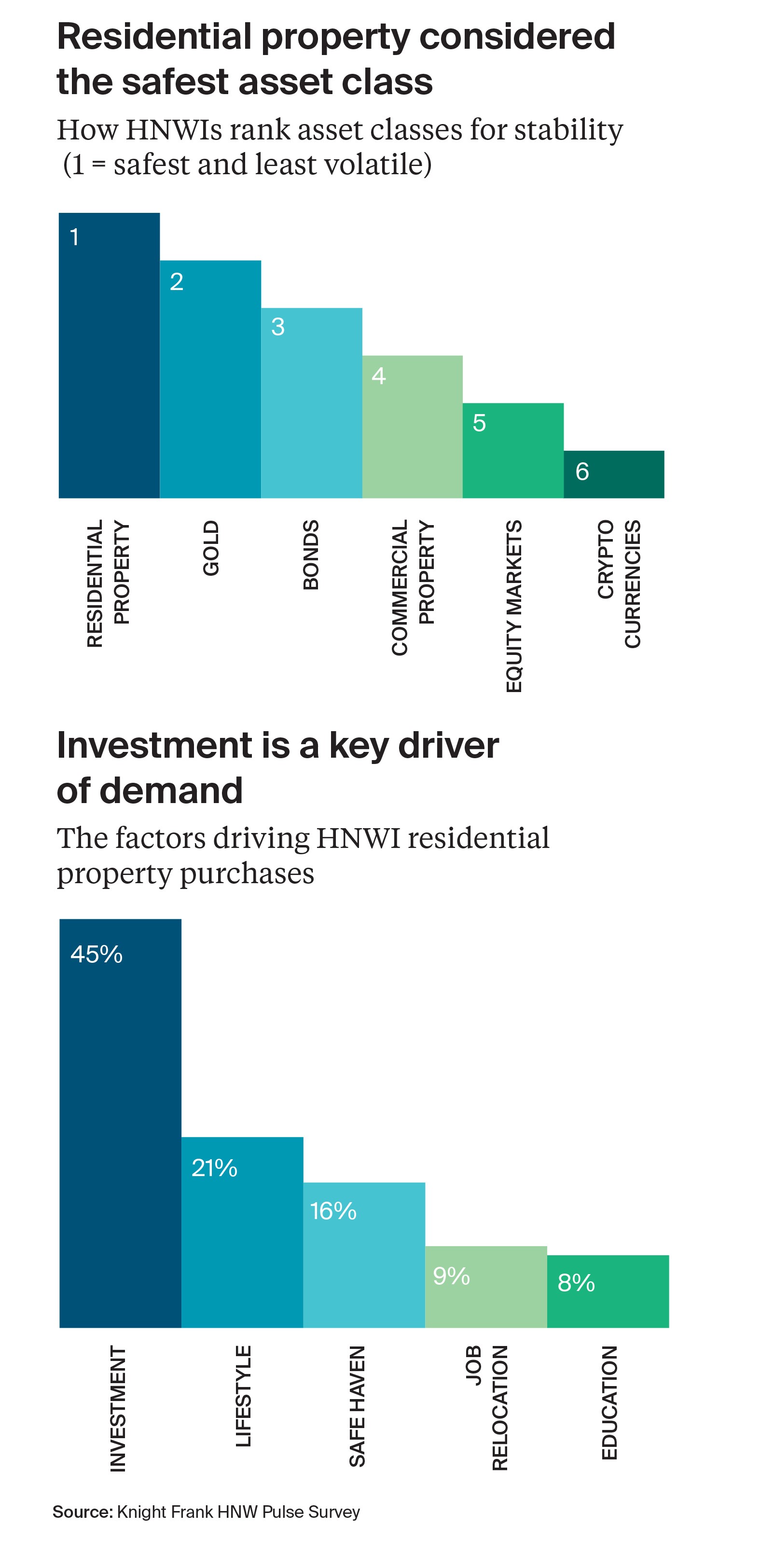

Global High Net Worth Individuals (HNWIs) consider residential property to be the safest asset class, according to our HNW Pulse Survey – a title usually afforded to gold. Equity markets and crypto both had a rocky 2022, relegating them to fifth and sixth spots respectively.

When it comes to the motivation behind their next purchase, HNWIs are focused on investment, particularly those based in Asia-Pacific (62%). For Europeans, however, an improved lifestyle (23%) and safe-haven purchase (19%) rank above the global average.

A new property cycle

Capital Economics identifies four phases in its anatomy of a housing market slowdown. Buyer sentiment takes a hit first, followed by buyer enquiries. Then developers pull on the brakes and sales weaken before, finally, prices feel the pinch.

Prime markets in most advanced economies are edging from phase three to four. How far prices fall – and how protracted a downturn we see – will depend on local factors, from economic activity and unemployment levels, to existing supply levels and the proportion of leveraged households in each market.

Then of course there is the million-dollar question of the future direction of interest rates. If, as many economists suspect, inflation has peaked in most advanced economies and interest rates are close to doing so, cuts may be on the horizon in the second half of 2023, bolstering buyer sentiment.

The challenge for agents in most prime markets, both cities and resorts, is lack of stock. Would-be sellers are delaying until interest rates reduce, with some opting to let their properties and take advantage of buoyant rental markets.

But headwinds will persist in 2023. The days of ultra-cheap debt are over. Regulation and taxes are on the increase with non-residents, the prime market and investors firmly in policymakers’ sights.

The reopening of China and the rolling back of its three red lines policy may put its developers on surer footing, but Xi Jinping’s goal of “common prosperity” will see price inflation closely monitored. With central banks moving at different speeds and – potentially – in different directions later in 2023, currency volatility will present risks as well as opportunities.

Discover more

Download

Download the full report for more in depth analysis and the latest trends relating to global wealth.

Download the report

Subscribe

Subscribe for all the latest insights and additional content.

Subscribe