Five-year mortgages below 4%

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

A once-in-a-generation moment

High-net-worth individuals seeking an entry point to the London office investment market typically have to compete with an array of very large institutions with deep local networks and access to cheap capital.

Current market conditions provide private investors with a window of opportunity to load up on assets at more attractive values in a less competitive environment. High net-worth individuals have set aside £3.4 billion to buy London offices this year, according to Knight Frank data shared with the Times.

About £2.4 billion of that total is expected to be deployed, 60% more than the £1.5 billion that foreign private investors spent in 2022. Most of the investment is expected to come from billionaire families in the Middle East and Asia.

“Buyers are well aware that prices have shifted and that this could be a once-in-a-generation moment to get [into the market] at much reduced prices,” Nick Braybrook, head of London capital markets at Knight Frank told the paper.

We'll have more on this theme in the Wealth Report 2023, due for release in March.

The House View

Every month we update our House View, which provides a high-level summary of our latest thinking on the key issues driving global property markets. This morning, you can read fresh updates on global office markets, UK capital markets, residential investment, UK industrial and logistics, and both UK and global economics.

Three highlights include news that the pricing in the industrial and logistics market is beginning to stabalise. Repricing has so far been rapid. In seven months, we have seen the same downturn in returns as recorded in the office sector downturn in the early 1990’s and the GFC that began in 2007 (see chart 1). The disparity between buyer and seller expectations continues, but the gap is closing and we expect investment activity to pick up over the course of the year.

Next is Lee Elliott's latest update on global office markets. The soon to be published Q4 edition of the Knight Frank Cresa Global Corporate Real Estate Sentiment Index will show improving sentiment around increasing the density of office occupation. More occupiers are adopting an office first stance, whereby some flexibility is afforded to staff, but the dominant place of work is the office.

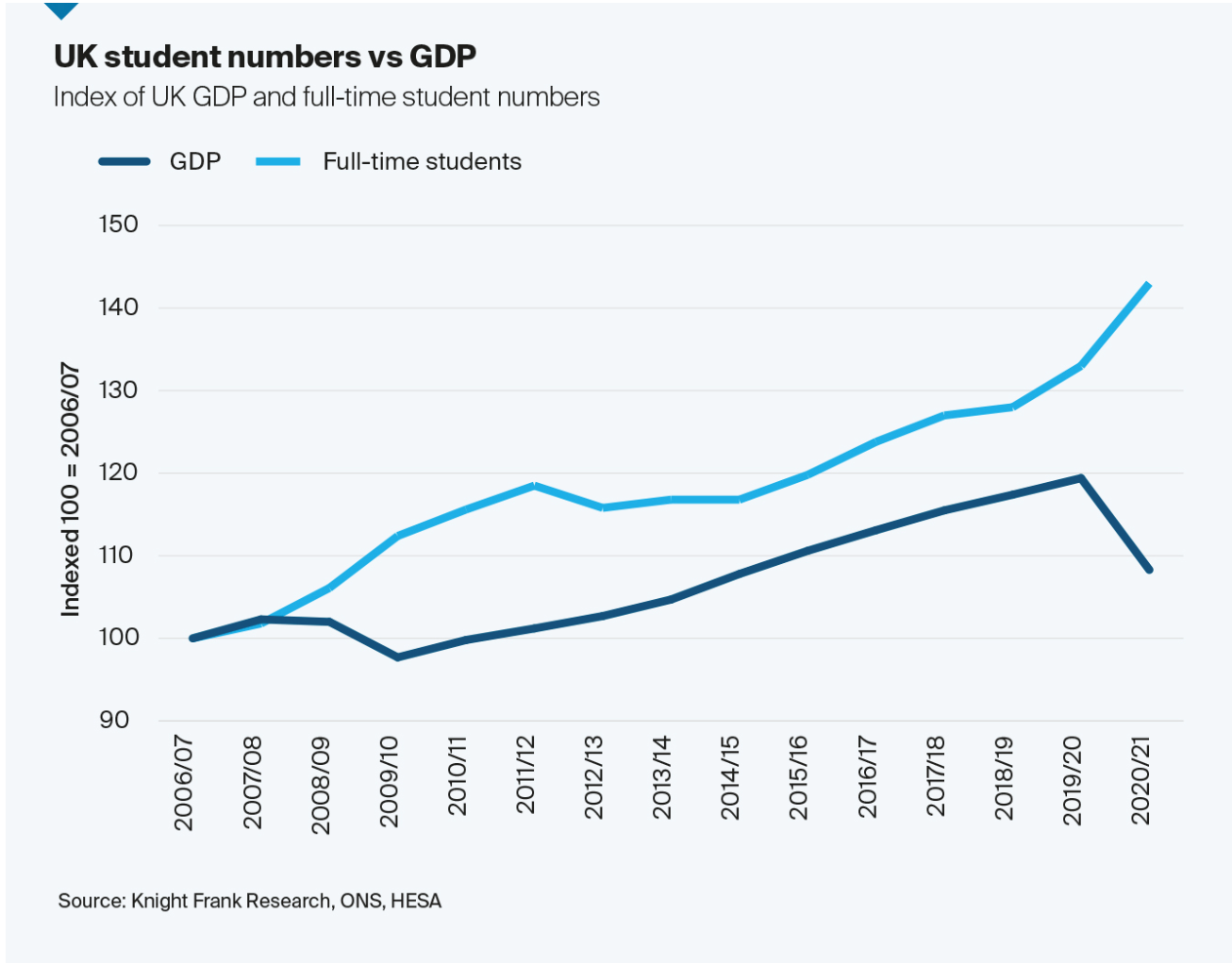

Finally, Ollie Knight's update on the living sectors includes the second chart, neatly illustrating why investors are so eager to gain exposure to residential during economic downturns. Demand for student living typically increases during economic dislocations as people return to education looking to upskill, and more college leavers choose to attend university before entering the workplace.

Five year mortgages below 4%

When the Bank of England raised the base rate to 4% on Thursday, the tone of the MPC minutes were notably more dovish than previous months. A repeated pledge to keep increasing rates "forcefully" if necessary had been dropped, sending five year swaps to the lowest level in months and the FTSE 100 to an all-time high.

Traders now anticipate one quarter-point rate rise in March, and that the Bank will then begin loosening monetary policy by the end of the year. The changed outlook has opened the door to five-year fixed mortgages below 4% - see the weekend FT.

That will underpin property market activity that surprised on the upside through January. The number of new prospective buyers registering during the month across the UK was 9% above the five-year average, the latest Knight Frank data shows. Meanwhile, the number of offers accepted was 44% higher and sales instructions were up 6%.

"Overall, a large proportion of new buyers are yet to market their own property, indicating they are coming to the market fresh, have accepted where mortgage rates are and need to get on with moving," says Christopher Burton, Knight Frank office head for Dulwich.

In other news

Barclay grandson raises £100m to turn old office blocks green (Times), mortgage lending set to fall to lowest growth since 2011 (Times), Amazon to shed UK warehouses after worst annual loss on record (Telegraph), Square Mile ‘needs closest possible relationship with Brussels’, says City minister, (Telegraph), and finally, is blowout jobs a headache for the Fed, or a back-to-2019 gift? (Reuters)