An era in which smart investing in real estate matters more

Real estate performance is expected to polarise. In the volatile macro environment, the right real estate may offer through-cycle diversification benefits and favourable risk-adjusted returns. The focus will be on high quality, ESG-focused assets in liquid locations.

5 minutes to read

Roll back to life before Covid-19. The macroeconomic scenario was one of cycles extending and the US treasury curve signalling a recession while markets debated higher interest rates, all in an environment of lower, long-term growth.

Active Capital posited that while it was too early to worry about a recession, it was not too early to strategise for one, with markets vulnerable to unknown shocks.

Fast forward through two further editions of Active Capital – the ‘Covid-19 editions’ – and that unknown shock has revealed itself. While Covid-19 has not yet disappeared, the economy and commercial real estate performance have increasingly dislocated from the health effects of the pandemic.

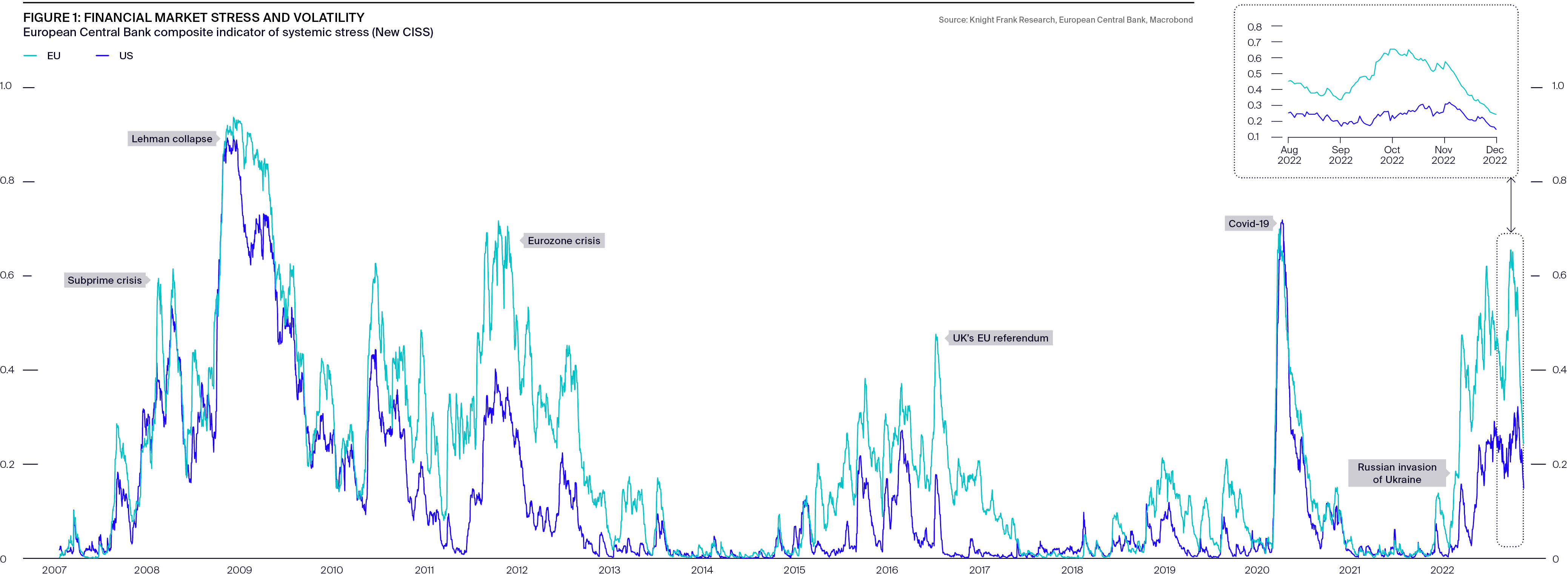

The world then faced a second significant shock: the Ukraine/Russia crisis. This presented a conundrum for governments and central banks: how to stabilise a predominantly supply-led inflation problem when the usual lever of interest rates is, at best, only weak in taming pricing.

The result is significant volatility across equity, bonds and currency markets, as forecasting houses diverge significantly in their outlook on rates.

Economics are forecast to deteriorate before they get better, and for the next 18-24 months, global interest rates are expected to peak before falling back in some locations. There is, however, significant variation in these forecasts.

Click on the charts below to enlarge

With real estate highly leverage dependent, all eyes are on the cost of debt:

- To what degree will banks and non-bank lenders adjust margins to offset rising swap rates?

- Will lenders refocus their lending?

- What will borrowers needing to refinance plan to do?

- How will real estate react to ongoing economic and financial conditions?

These are among the questions Active Capital seeks to answer.

Increasing interest rates

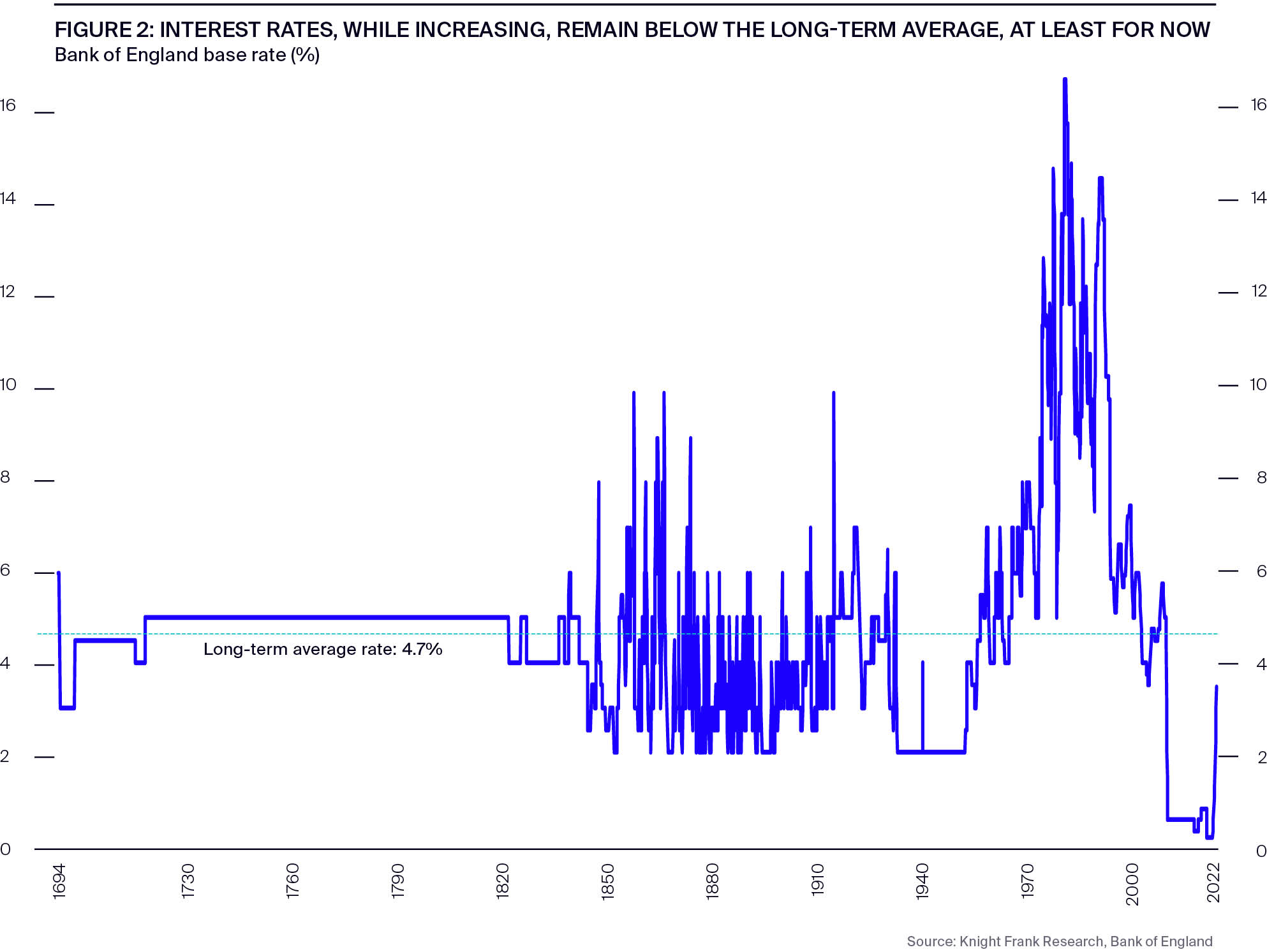

It's worth keeping in mind that while interest rates have increased, in many locations, at the time of writing, they remain below their long-term averages even though they are significantly elevated compared to recent history. Refer to Figure 2.

Real estate diversification

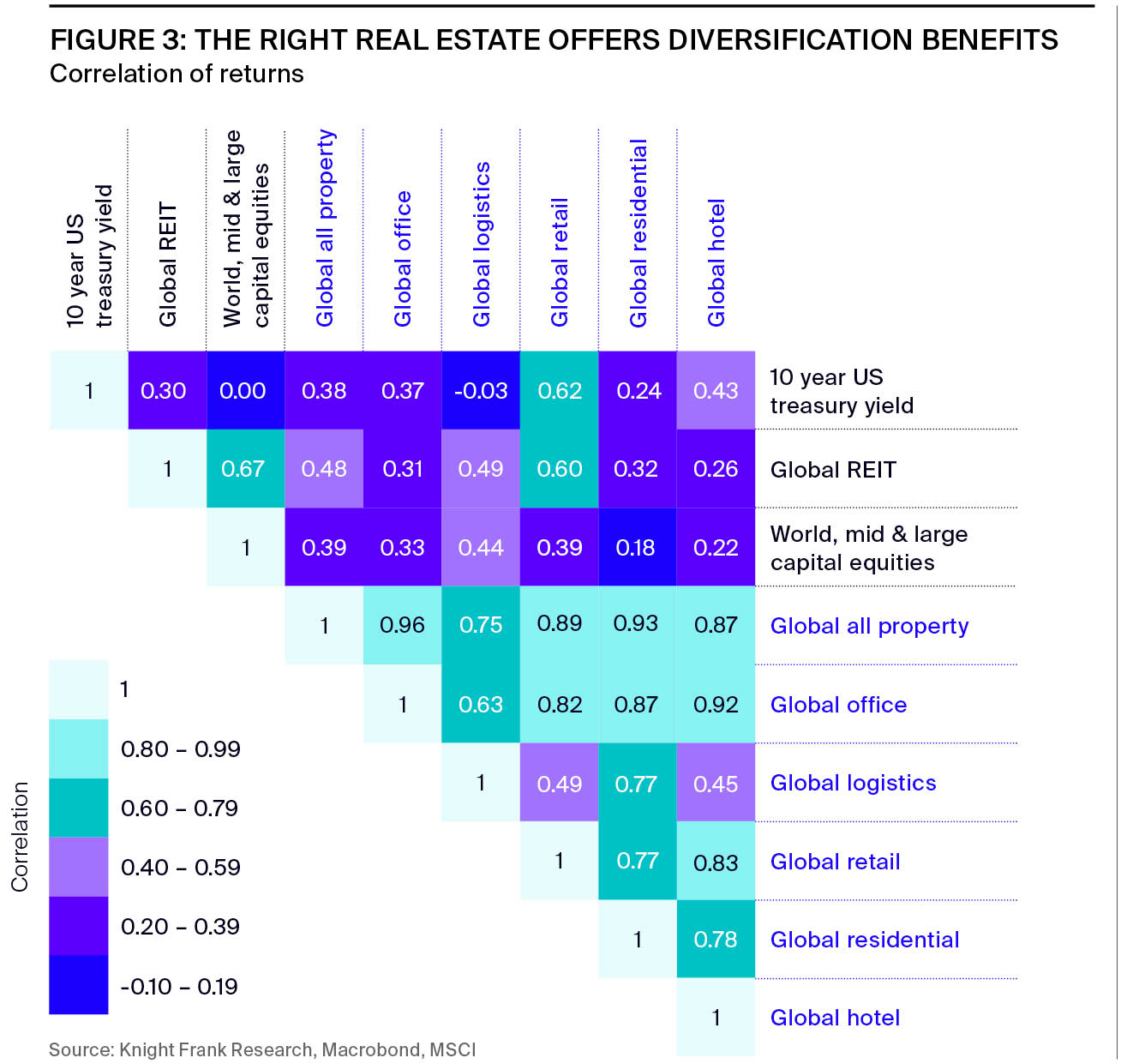

Against this uncertainty, there remains a case for the right real estate. Real estate continues to offer diversification.

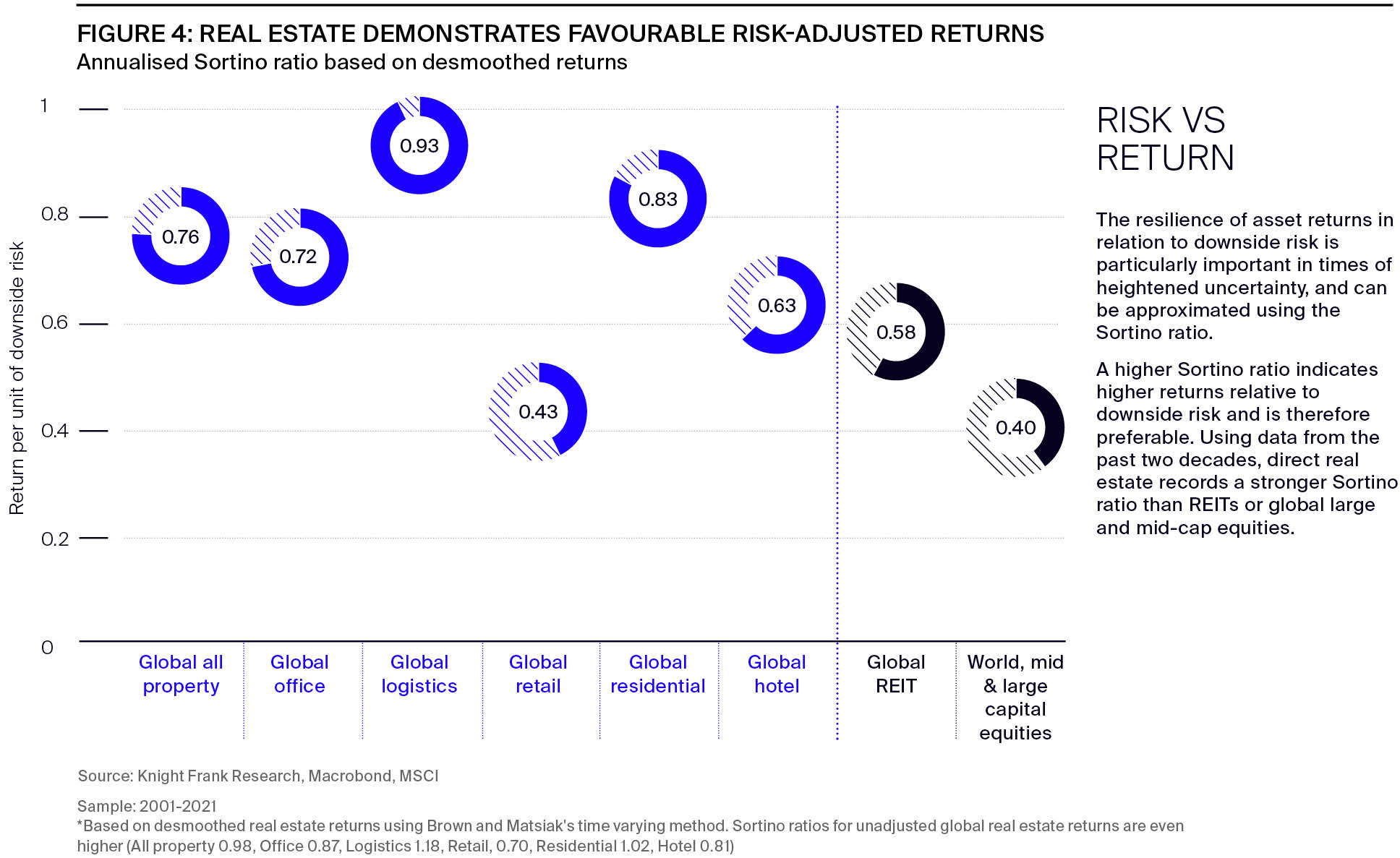

Risk vs return

Previous cycles have also demonstrated that risk-adjusted returns from real estate investment outperform those of indirect real estate. Not all real estate will perform equally, and investors will need strategies to position for resilience amid choppy waters.

Within sectors, we are likely to see polarisation in performance. Increased investor demand combined with the financing landscape may mean that the spread between prime and non-prime yields widens, with some non-prime assets potentially repricing to levels which become economical for repositioning or repurposing.

Previous editions of Active Capital set out aims for investors:

- Focus on local market dynamics

- Examine market liquidity

- Explore asset classes that align with structural changes, such as an ageing population

- Consider accessing real estate lower down the capital stack through debt

- Consider ESG-targeted assets

In the coming months, these strategies will become even more important. We have already highlighted the expectation of polarisation between best-in-class, ESG-targeted assets in well-understood, liquid locations and everything else.

We expect investors to focus particularly on those core, liquid assets and locations with attractive yields relative to the cost of debt, following either the movement in pricing or where yields were relatively attractive on a comparative basis to begin with; London’s office sector, for example.

There remains a case for those assets that benefit from changing ways of living, in terms of both demographics and technology.

Logistics saw a significant increase in demand through the pandemic and still has a role to play.

Living sectors

As we highlighted in Active Capital 2019, the residential sector benefits from structural changes throughout its lifecycle.

Demand for student living typically increases during economic dislocations, while other residential offerings will continue to face an excess of demand to supply, particularly in evolving markets such as Spain and the UK. In areas with an ageing population, demand for senior housing will continue to grow, while affordable housing is counter-cyclical and often undersupplied.

Development could prove challenging in the year ahead in some markets due to significant increases in construction materials costs, material and labour shortages. This may support pricing in markets with undersupply, PRS in the UK, for example, as the tap is turned off for new builds.

We expect novel ways to overcome some of these challenges, particularly with factory-built housing and using recycled development materials such as steel, increased interest in embodied carbon, and more focus on refurbishments over the short to medium term.

Counter-cyclical sectors

Counter-cyclical sectors such as discounters and lower beta food stores are expected to continue to hold demand.

Retail

The diverse retail sector has largely adjusted its dislocations. Shopping behaviours are changing in varying ways and at different speeds globally but have now rightsized across many markets.

Office

There is still a case for the office sector despite the ‘great workplace experiment’ as referenced in (Y)OUR SPACE. The focus will be on those most global, liquid, safe haven locations such as London, UK, key German and Japanese cities and Amsterdam, Netherlands, to name just a few.

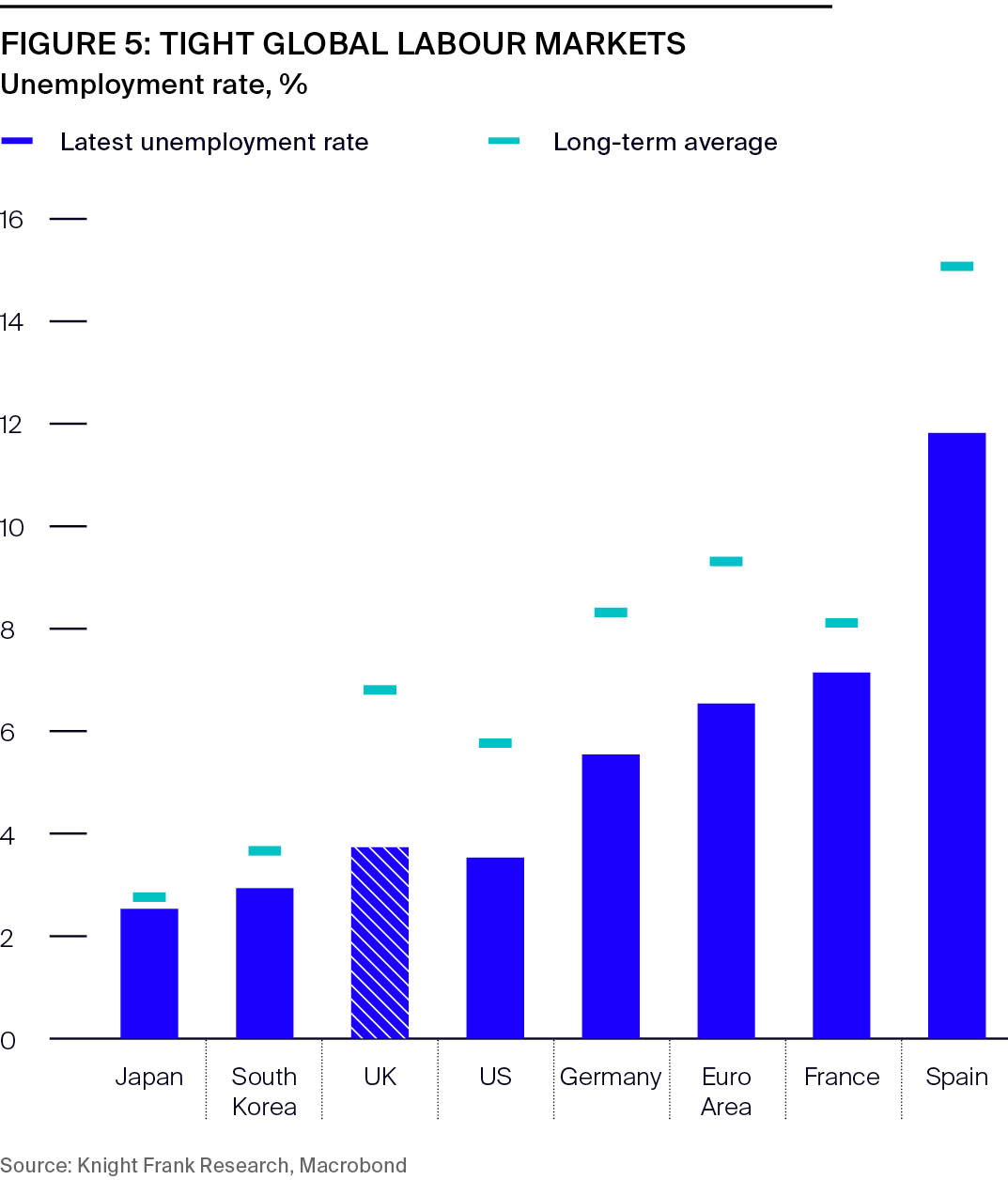

Best-in-class buildings with excellent ESG credentials we forecast to continue to offer potential to deploy capital. While unemployment shows upward intent over the next 18 months, in many locations it is currently at record lows with above-normal average job vacancy levels.

The great workplace debate remains, but varied working practices were a theme well before the pandemic with no adverse effect on yields. According to Eurostat, in 2019 around 37% of employees in the Netherlands and Sweden and more than 25% in the UK, “sometimes or usually” worked from home. Investors must look through the noise in these uncertain times.

Innovation-led cities

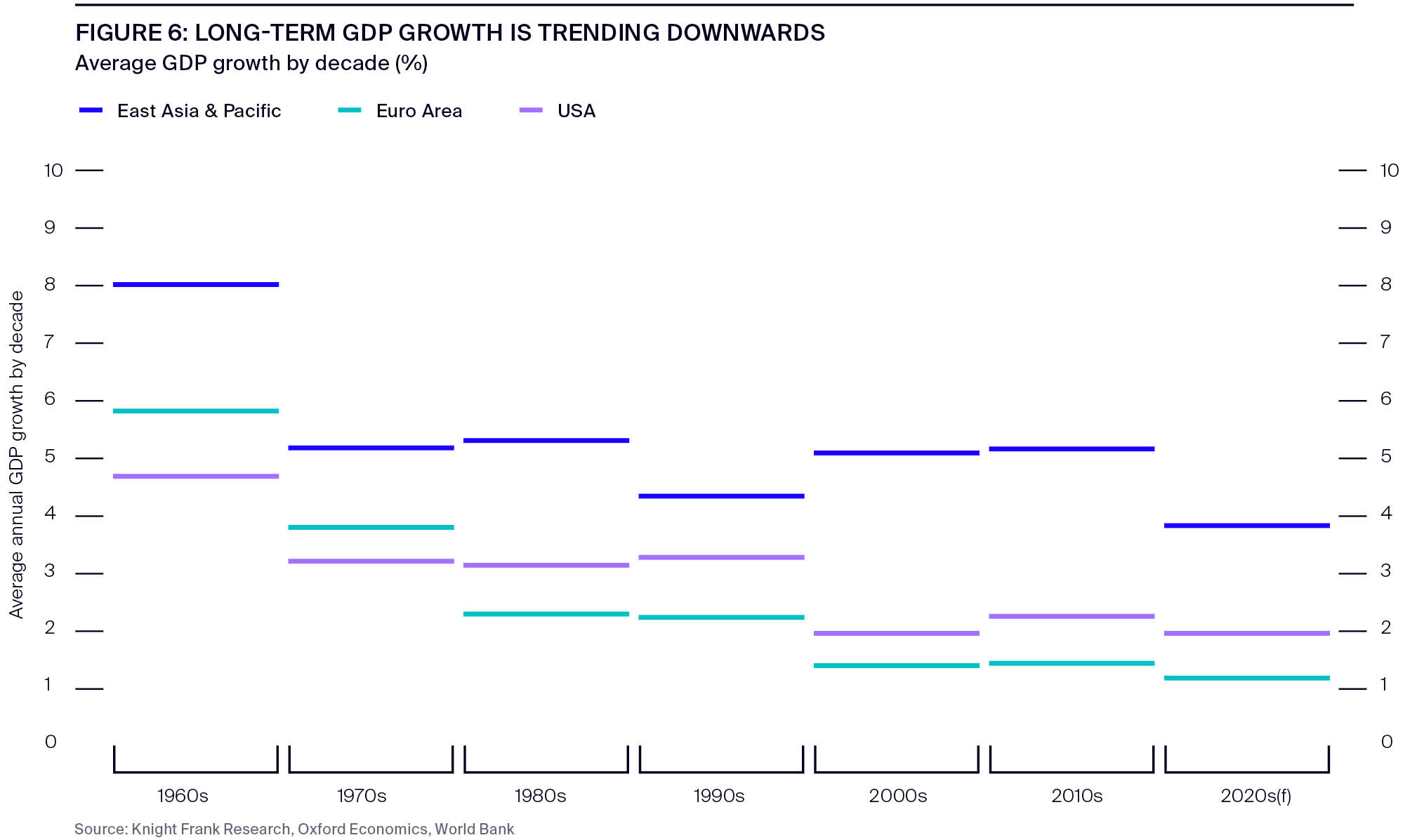

In a long-term lower-growth environment, as evidenced in Figure 6, our analysis on innovation-led cities with the underpinning to support local growth and relative resilience from down cycles becomes increasingly relevant. Innovation is a key driver of growth, supporting the population and wealth required for well-functioning real estate markets.

Previous analysis of innovation-led cities is available in our archives, with cities such as London, Tokyo, New York, Paris, Boston, Seoul, and many others, small and large, attracting innovation through funding availability, research institutions, universities, and the culture of start-ups and enterprises.