Reshoring – Areas of opportunity

Identifying the key sectors or drivers of reshoring can help us identify the locations of opportunity, with manufacturers in the same industries tending to cluster in hubs or corridors.

8 minutes to read

Certain sectors will choose to locate in areas where experienced labour is present, or component manufacturers may choose to locate close to assembly and later stages of production. However, reshoring across broad industries is typically not possible, or desirable given cost implications and inefficiencies involved in bringing back home some part of supply chains. That said, there could be opportunity to bring back high value component part manufacturing across a range of industries.

Automation and digitisation

The ability to automate or digitise production makes an industry more likely to reshore operations. Automated procedures can reduce the reliance on human labour, the cost of which is often a key factor determining production locations. Advanced production methods, automation technologies and robotics are having a huge impact on the types of labour needed for manufacturing. A need for large numbers of unskilled labour is being replaced by demand for specialist skilled labour. While unskilled labour is relatively abundant globally, these specialist skills are scarce.

Increased automation and high tech manufacturing necessitates higher levels of investment. As capital expenditure increases, property protection rights as well as tax and investment incentives, the stability of the economy and the political system will all become increasingly important for firms making location choices for their manufacturing bases. With increased technology and digitisation comes greater reliance on power and digital infrastructure. The cost, reliability and environmental impacts of both physical and digital infrastructure could motivate firms to relocate their manufacturing bases.

ADDITIVE MANUFACTURING: While not all parts can be manufactured in this way, additive manufacturing (3D printing) can remove or reduce the need for physical inventory, thus reducing shipping and storage costs. If parts can be scanned to create a digital version and stored in the cloud, then a digital scan set to a 3D printer to manufacture locally, there is no longer a need for lengthy supply chains and large stock holdings. Though this may reduce the need for warehousing space in the traditional manufacturing centres, this need is replaced by a need for high tech manufacturing space in or close to consumer markets.

DB Schenker has launched a new on-demand production service using additive manufacturing. Its new virtual warehouse can provide spare parts for its customers from the mechanical engineering, automotive, and rail transport markets with parts produced locally on demand, via a 3D printer.

Automation and reshoring are bringing opportunities for manufacturing firms and investors and will have significant implications for location choices and real estate requirements. With firms investing more in automation and the fit out of their facilities, they will want to remain in those facilities for longer and are likely to amortise their capital expenditure over their lease period. Meaning long term stable income for investor.

The ability of the UK to capture the growth in global high tech industry and to attract manufacturing to (or back to) the UK will depend on various factors, including: labour costs, availability of skilled labour, infrastructure reliability and connectivity, investment incentives, corporate tax rates, political and economic stability, access to markets (trade agreements) as well as regulatory efficiencies, the rule of law and the level of state intervention in investment and financial processes.

High value manufacturing

Due to the post Brexit rules of origin and the strengths of the UK market, which include highly skilled labour and robust intellectual property rights, the opportunity for manufacturing growth and reshoring lies in advanced, high value manufacturing.

The High Value Manufacturing Catapult, which supports the growth and success of high value manufacturing in the UK, launched in 2011. Today there are 25 sites around the UK. Opportunities for the growth of high value manufacturing could be found in locations close to these centres, due to their fostering of links between industry and academia, through investment, knowledge sharing and collaboration.

Critical infrastructure

Rising geopolitical tensions and the Covid-19 pandemic have brought into focus the need to strengthen critical supply chains. In early 2020, many countries started halting exports of critical medical supplies in order to keep supplies at home, leaving import dependent countries unable to secure supplies. The war in Ukraine has further highlighted the vulnerability of some of our vital supply chains, including energy and food.

The UK has 13 defined Critical National Infrastructure Sectors: Chemicals, Civil Nuclear, Communications, Defence, Emergency Services, Energy, Finance, Food, Government, Health, Space, Transport and Water. While most of these are already located here in the UK, pharmaceuticals, medical equipment, defence equipment, food and energy may be sourced offshore. The need for security around these critical supply chains should drive an increase in domestic production in these sectors or industries. It is perhaps not surprising that pharmaceuticals, healthcare, vaccines, life sciences and PPE firms topped the list for mentions of 'reshoring'. Fuels and energy firms and aerospace and defence firms are also talking about reshoring.

Medicinal and pharmaceutical products are in the top 3 goods exported from the UK, with the UK a net exporter of medicinal and pharmaceutical products (worth £20.3 billion in 2021). Pharmaceutical and life science companies are focused geographically around the Oxford – Cambridge Arc, though there are also clusters growing in other UK cities. Indeed, 50% of jobs in the sector are located outside of London and the South East (Bioscience and heath technology statistics 2020). Links with leading academic institutes is key to driving location choices for these firms. However, production may not take place alongside the research and development of products and many SMEs in the sector have no manufacturing capabilities and will outsource production.

Quality control and intellectual property rights could be reasons for firms to choose to manufacture within the UK. The desire to control domestic supply of these products and create high value job growth within the UK are key reasons for the government to incentivise UK production. The government has various funds that support life sciences investments including the £60 million Life Sciences Innovative Manufacturing Fund (LSIMF).

Spread across the UK, the High Potential Opportunity (HPO) scheme, run by the Department for International Trade (DIT), works with local partners and identifies opportunities to attract international investment into emerging, fast-growing sectors, regions and clusters. These include; chemicals in the Humber, biomanufacturing in Tees Valley, Medtech health in Wales and vaccine development and manufacture in Liverpool City Region.

Fujifilm Diosynth Biotechnologies (Japan) recently committed £400 million to create the largest multi-modal biopharmaceutical manufacturing site in the UK, creating up to 350 highly skilled jobs on Teesside. PCI Pharma (US) is expanding their manufacturing facility in Tredegar, Wales. The expansion will help the company keep pace with global demand for the production of cancer therapies, and will add about 200 jobs once the facility is at full capacity.

Automotive

As part of the zero-tariff free trade agreement agreed between the UK and EU, rules of origin (ROO) were introduced, these criteria must be met in order to access tariff-free treatment for goods exports and imports to or from the EU. In effect, the ROO limit the proportion of imports from outside the UK/EU that can be used to create a product that qualifies for zero-tariff trade.

The UK-EU Trade and Cooperation Agreement (TCA) temporarily exempted electric vehicles (EVs) from the ROO because such a large proportion of the car's value (c.30-45%) comes from the batteries, which are imported from Asia. Until 2024, at least 40% of the content of EVs and 30% of batteries must originate in the UK or EU. From 2024 (until 2027) this will increase to 45% of EVs and 50% batteries. If you combine the ban on petrol and diesel by 2030 and the tightening tariff rules by 2027, there may be an acceleration of change in the automotive production supply chain. This will necessitate increased battery and EV production in the UK and EU and reduced sourcing from Asia.

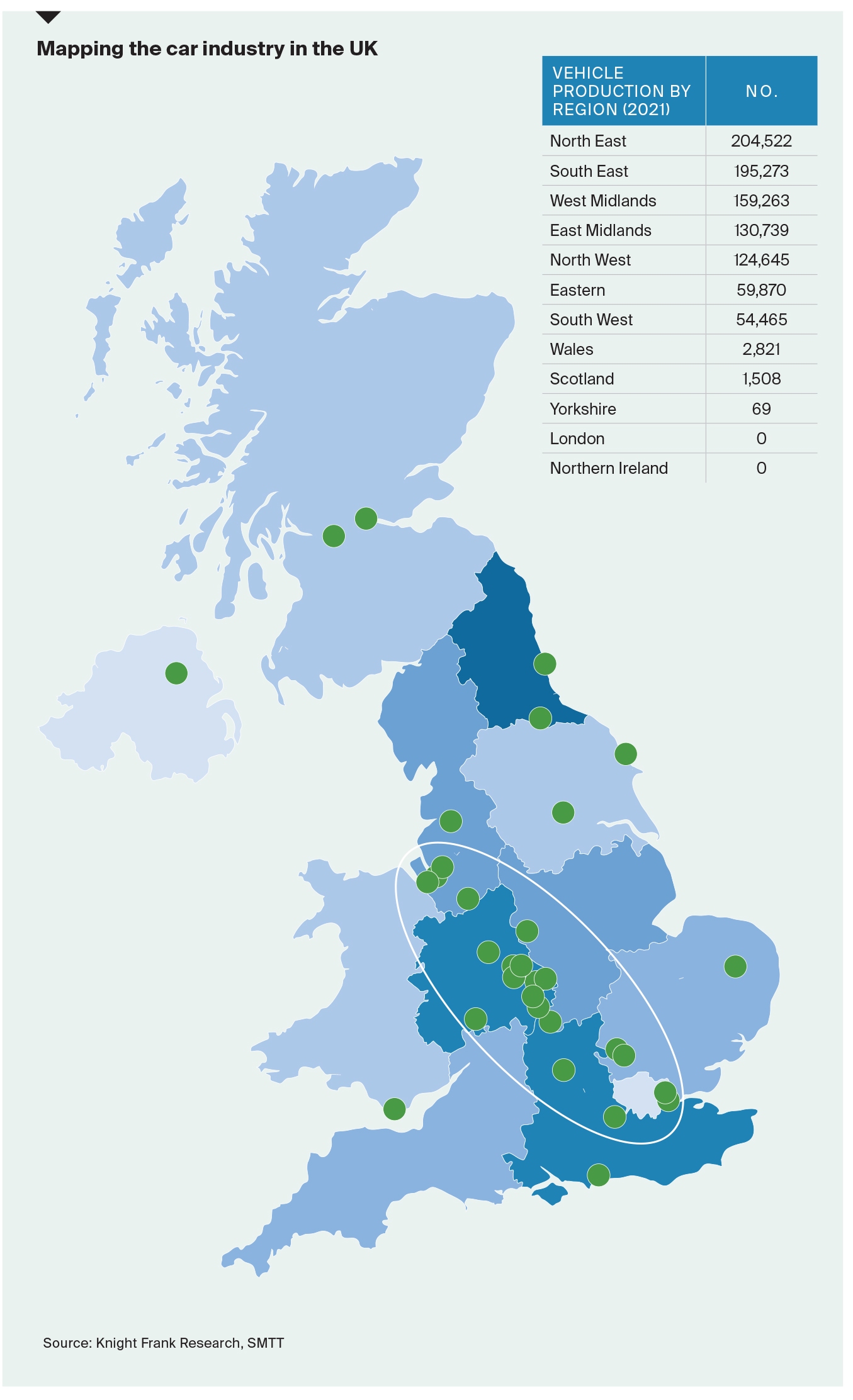

The UK has a total of 32 automotive assembly and production plants (SMMT). While the North East region is the largest vehicle producer, the West Midlands is home to the largest number of plants, there is a notable cluster of plants along the M6 and M40/M1 between London, Birmingham and Liverpool. The need for increased EV and battery production could be expected to benefit these same areas, due to the clustering effect along with existing labour skills and facilities.

Port locations could also be an important draw, the ports of Grimsby & Immingham, Bristol, Tyne, London and Medway are key hubs for the import and export of motor vehicles (Department for Transport, Port Freight Statistics).

Mapping the car industry in the UK

Source: Knight Frank Research, SMTT

Freeports

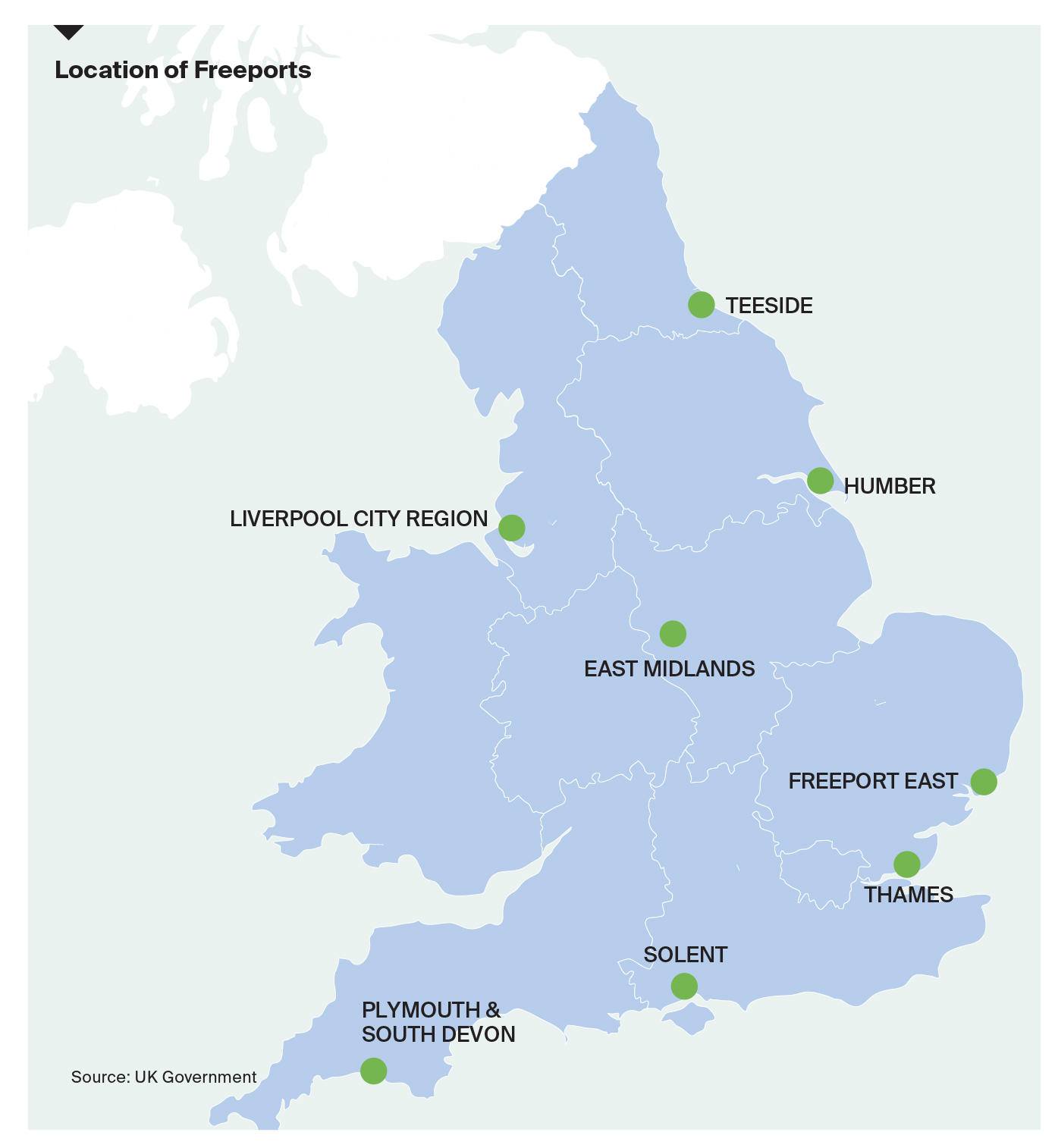

The benefits of Freeports are relevant to all businesses, not just those focused on import/export operations. They could also present an appealing location for firms seeking to reshore manufacturing operations due to the range of tax incentives and reliefs.

The potential for tax savings is significant. The NIC relief could be particularly appealing to manufacturing firms establishing new facilities with more labour-intensive operations. The capital allowances could incentivize firms committing to large capital expenditure on plant and machinery. Business rates relief (at 100% for five years) could be particularly valuable, particularly given the ratings revaluations in April 2023. Industrial and logistics occupiers are likely to face large increases due to sector’s strong rental growth over the ratings revaluation period (Q1 2017 to Q1 2021).

Location of Freeports

Source: UK Government