Exploring the growth potential for manufacturing in the UK

According to the McKinsey Global Institute, 15-25% of global exports could potentially shift to different countries over the next 3-5 years. With global trade worth US$28.5 trillion in 2021 (UNCTAD Global Trade Update), there is huge opportunity.

3 minutes to read

The 'reshoring' opportunity for the UK lies in high value parts of the supply chain and in manufacturing processes undergoing significant automation. As supply chains and production bases shift, the requirements for First Mile logistics and infrastructure may also evolve, creating opportunity.

The UK manufacturing landscape

Manufacturing retains a strong role in the UKs export economy. Although the sector only contributes 10% of GDP, it comprises 44% of exports. The UK’s manufacturing industry has been strengthened recently by the drop in the value of the British pound against the US dollar and the euro, thereby facilitating an increased demand overseas for UK goods.

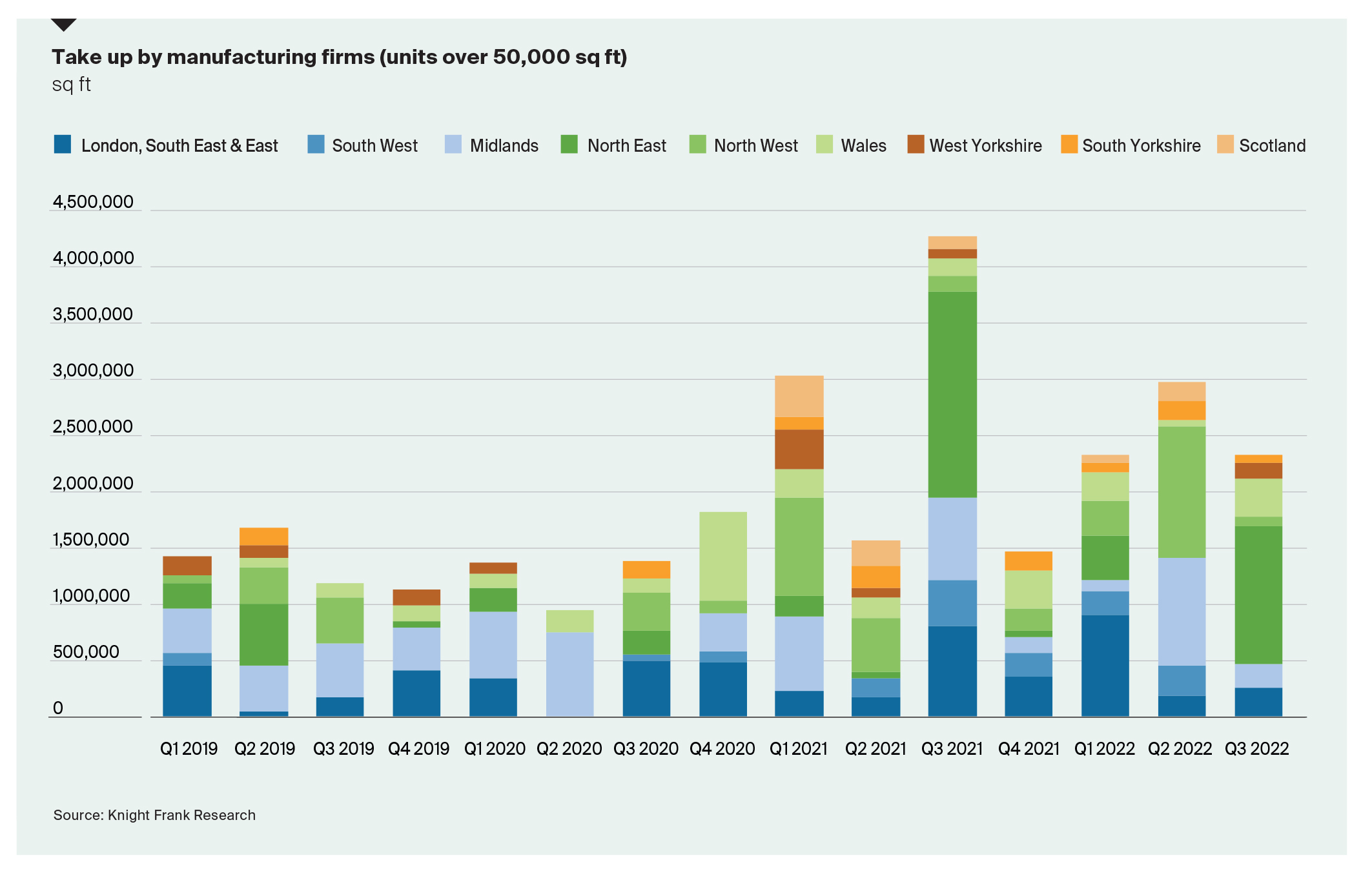

The UK’s manufacturing sector expanded in 2021, with product sales of £401 billion, up 9.4% year-on-year. However, sales remained lower than in 2019, when £402 billion was recorded (ONS). Manufacturers’ take up of industrial and logistics space has increased in 2021 and 2022, pointing to a continued expansion and enquiries remain robust as we go into 2023. In 2021, manufacturers took a total of 10.3 million sq ft (in units over 50,000 sq ft), compared with 5.5 million sq ft in 2020 and 5.4 million sq ft in 2019. In the first three quarters of 2022, a total of 7.6 million sq ft of manufacturer take up was recorded.

Despite an uptick in the take up of space in recent years, employment in manufacturing has been in decline over the past forty years. In 1980, the UK had more than 6.3million employed in manufacturing, accounting for 23% of the workforce. By 2021, this had fallen to a low of just 2.5 million, 7% of the workforce. It is forecast to shrink further and account for less than 6% of the workforce in ten years’ time (Oxford Economics).

While the numbers of workers employed in the sector are falling, the amount of space needed appears to be rising, as too does investment into manufacturing. Investment in real terms has increased 51% over the past ten years (ONS) and is forecast to rise a further 17% over the next ten years (Oxford Economics). This may be due in part to reshoring, as well as a need to improve efficiencies and the growth of high value manufacturing within the UK.

Over 70% of all UK manufacturers believe that conditions are right for improving export growth and 76% of manufacturers in the UK have a strategy they believe will help their business grow overseas (Source: Brookings Institute). However, the UK’s trade deficit for goods has continued to grow over the past 20 years. If the UK is to reduce this deficit, it will need to become more competitive and this will mean selecting industries and sectors where the UK can excel, specialising in high value-added upstream segment of the chips supply chain, while simpler manufacturing processes will continue to be offshored (typically to Asia).

Whatever the scale of opportunity that reshoring presents, what is clear is that the functions and jobs that were lost to offshoring, will not be the same as those created by these new opportunities.

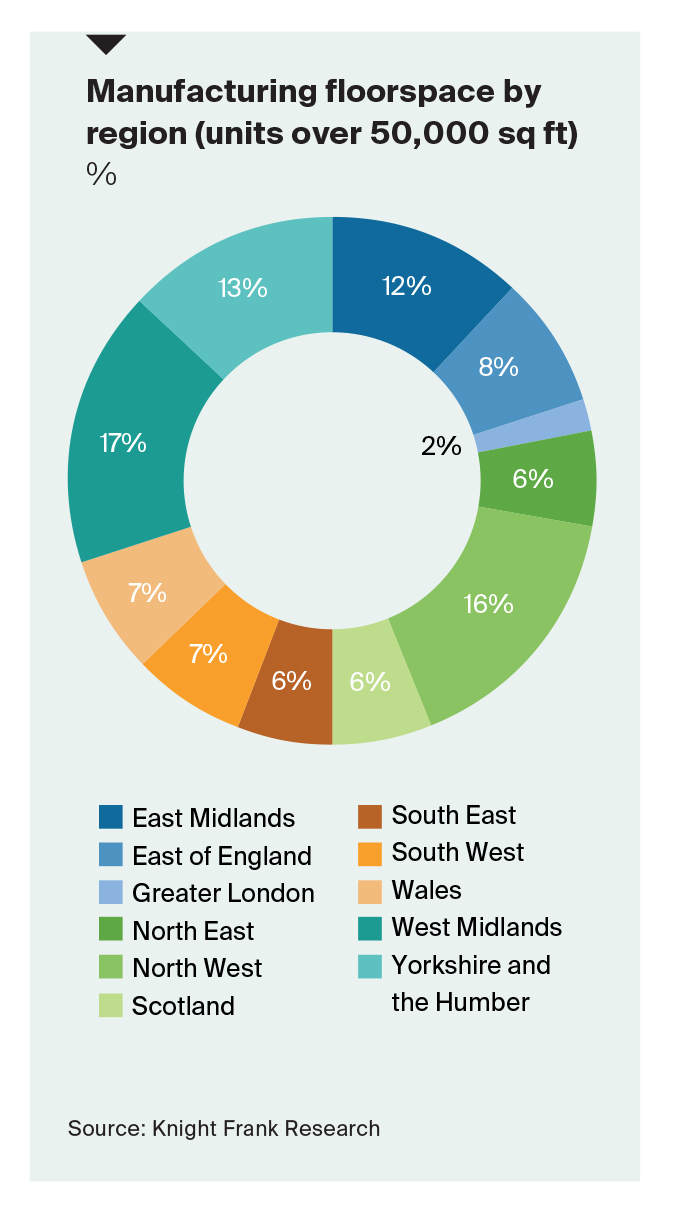

Manufacturers are estimated to occupy around 392 million sq ft of industrial floorspace across the UK (in units over 50,000 sq ft). The largest concentrations are in the West Midlands and the North West, followed by Yorkshire and the Humber and the East Midlands.

With manufacturing investment expected to rise 17% over the next ten years (Oxford Economics), the sector is likely to place further demands on industrial land and floorspace, as well as continued investment into facilities. This change in the occupier base is likely to mean longer leases (compared with retailers or distribution firms) and different preferences in terms of fit-out and location.