Steady investment appetite in Hong Kong SAR

Has continued disruption by the pandemic affected investment appetite in Hong Kong SAR? It seems not.

3 minutes to read

Despite continued disruption by the pandemic, Hong Kong SAR government committed huge sums of financial subsidies to support the overall business environment which has strengthened the business confidence of foreign investors.

Overview of investment outlook for 2021

The city’s economy enjoyed a significant rebound with annual GDP growing by 6.4% in 2021. Total inbound cross border volume in Hong Kong SAR reached HK$12,765 mn in 2021, surging by 6.8% YoY.

In terms of consideration, the industrial sector constituted the top deals. These included the sale of 12 floors in Cable TV Tower for HK$2,614 mn, which was purchased by a joint venture of UK investment manager Schroders and Canada investment manager BentallGreenOak; the sale of en bloc Kai Bo Group Centre for HK$1,435 mn to the U.S. investment manager Angelo Gordon; and the sale of several floors of Hang Wai Industrial Centre Block C for HK$946 mn to Asia-based investment manager Silk Road Property.

Industrial property market boosted by strong policy support

Thanks to the Hong Kong SAR government’s policy support including Revitalisation 2.0 and the industrial standard premium rate pilot scheme, industrial properties became keenly sought after.

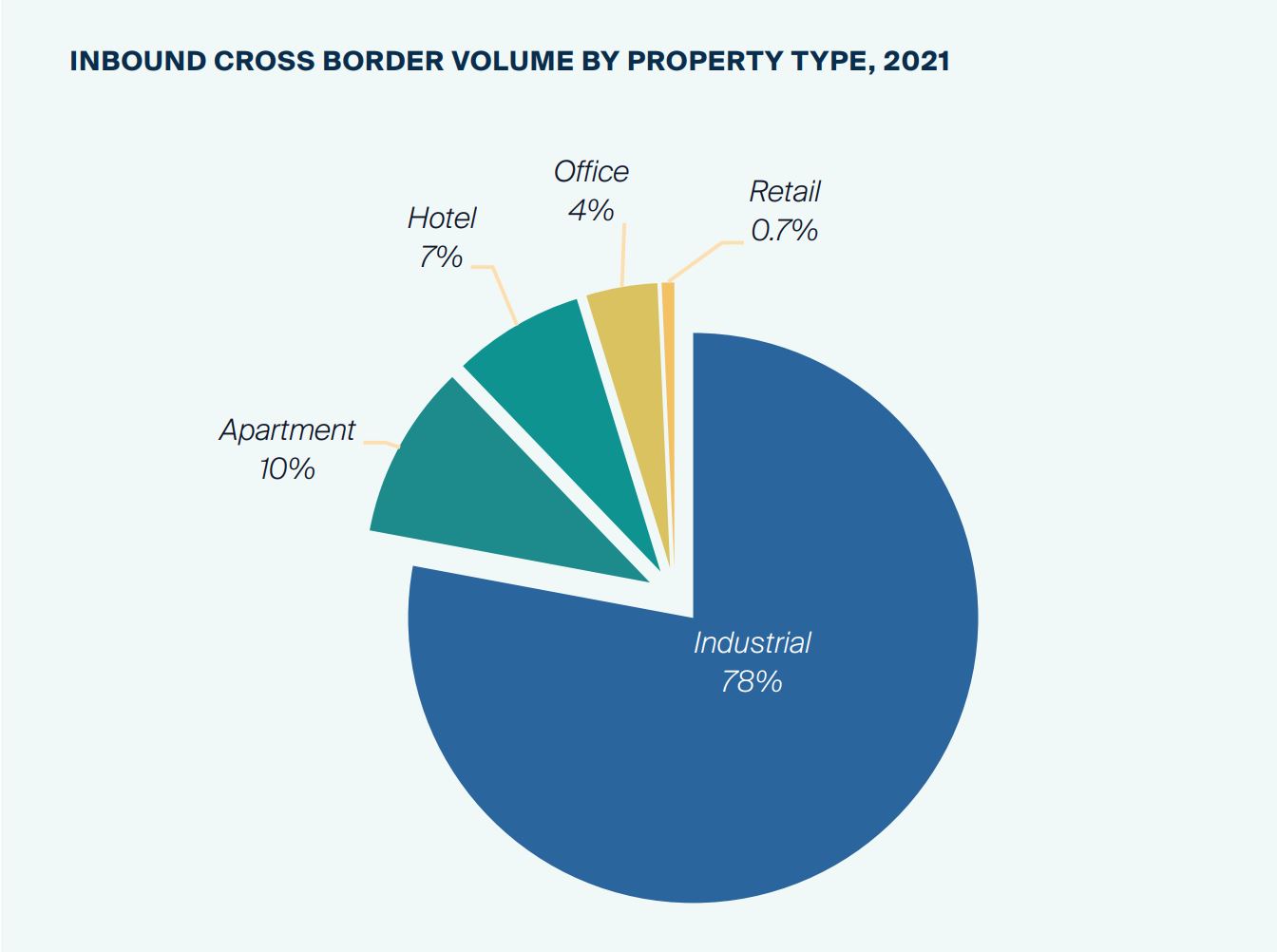

It was the top sector in supporting the investment market in 2021. With HK$9,948 mn worth of assets changing hands, it dominated 78% of the overall transaction volume. This was followed by the apartment and hotel sectors, which contributed 10% and 7% of the overall volume, respectively.

Canada, U.K. and Singapore were the top capital sources in 2021, amounting to HK$3,570 mn (28%), HK$2,620 mn (21%) and HK$2,598 mn (20%), respectively. Top inbound cross border investors in 2021 included the U.K. investment manager Schroders, Canada investment manager BentallGreenOak, the U.S. investment manager Angelo Gordon and Sydney-based Goodman Group.

Steady outlook for Hong Kong SAR in 2022

Looking ahead, given (1) the ease of COVID situation, (2) the withdrawal of non-residential property cooling measures in 2020 and (3) the resilient demand, transaction volume in 2022 is expected to follow the high growth trajectory of 2021.

Regardless of the U.S. Fed raising interest rates, Hong Kong SAR’s commercial banks, according to historical records, may not follow the pace and frequency of future Fed rate hikes. With the interest rate staying low in the foreseeable future, yields are expected to remain compressed.

Despite current challenges, investment appetite from investors is expected to remain steady. However, investors may look for more attractive entry opportunities as the market is still volatile.

Going forward, we expect high-specs industrial buildings, in particular, modern logistics, cold storage and data centre properties to remain sought-after by investors amid the booming e-commerce landscape.

On the other hand, due to low occupancy rates during the pandemic, several underperforming hotels such as Butterfly on Prat and Hotel Sav were acquired and converted into long-stay accommodation. We expect repurposing of hotels to be a growing trend.

Last but not least, investors are placing greater emphasis on Environmental, Social and Governance (ESG). We believe institutional investors will pay a strong focus on ESG and green assets in the future.

Inbound cross border volume by property type in 2021

Top 3 trends and drivers in Hong Kong SAR

• Strong demand for industrial assets with value-added opportunities,

particularly modern logistics, cold storage and data centre

• Asset repurposing of hotels into co-living or other uses for higher yields

• Acquisition of aged buildings for redevelopment

Sectors to watch for Hong Kong SAR

• High-tier industrial (Especially Cold Storage and Data Centre)

• Hotel

• Prime residential

__

This piece was originally published in 'Rising Capital in Uncertain Times' Active Capital Asia-Pacific Perspective (June/July 2022)'. The report aims to provide an insight into how the real estate market in Asia-Pacific performed historically and how it is predicted to play out in 2022, thereby acting as a guide for investors.

It also highlights an important theme – Environmental, Social and Governance (ESG) – for investors that are looking to expand their ESG foothold in their portfolios.