Growth in the fast lane

Cultivating business communities and harnessing the ambitions of fast growth organisations creates the potential for amplified growth and supports resilience against disruption.

4 minutes to read

Knowledge intensive organisations will lead real estate requirements over the next decade, but which sectors will be at the forefront of growth?

Innovation is essential in the pursuit of commercial success, with real estate central to creating the right conditions for new ideas to take root and flourish.

An understated attribute of the office is its role in the creation of business communities, both within the immediate building envelope and as part of a wider cluster. This is particularly true of centres of high knowledge and research which thrive on innovation and a highly skilled labour force. Understanding the evolutionary direction of existing sectors and also the growth potential of newly forming companies, is critical in identifying the structure and scale of future occupational demand in the UK cities. But with a new industrial revolution firmly underway, the landscape is increasingly blurry.

What sectors offer the greatest potential over the next cycle?

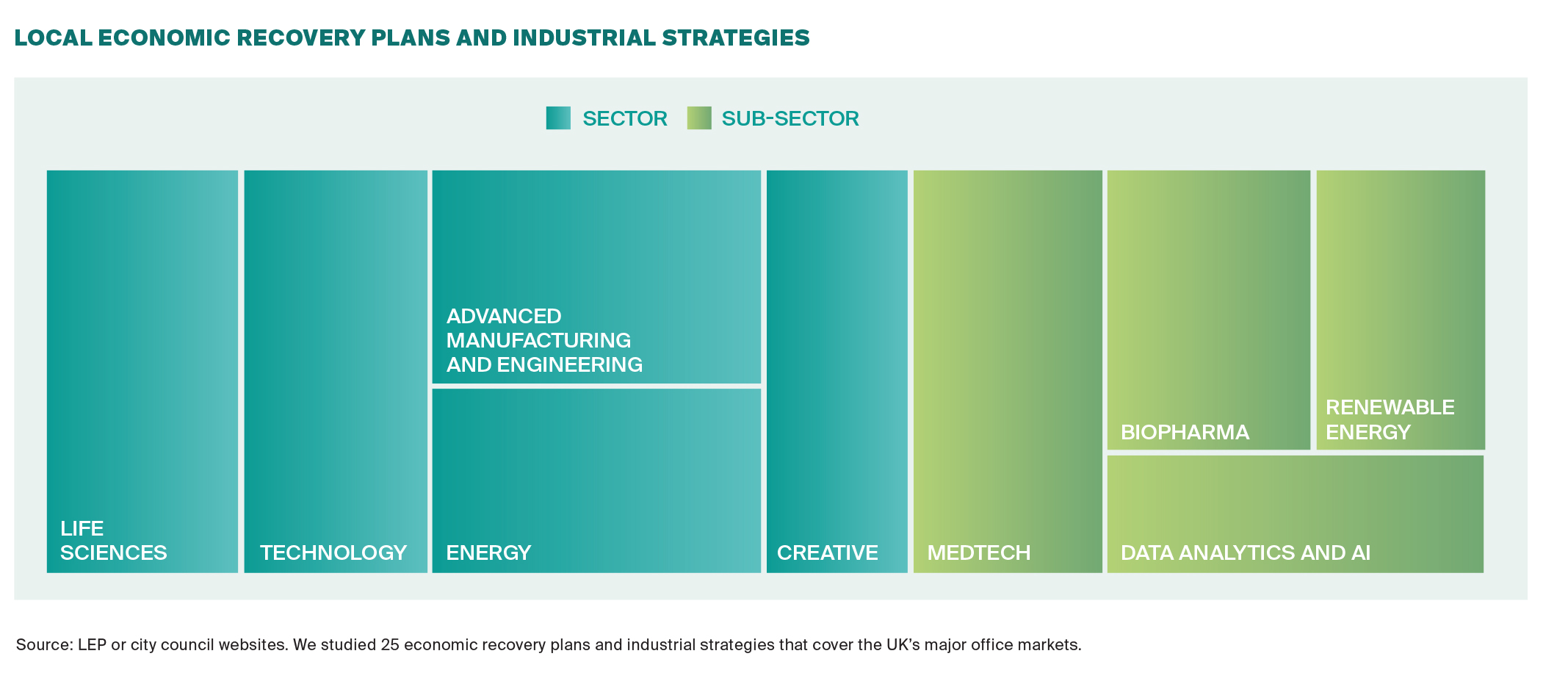

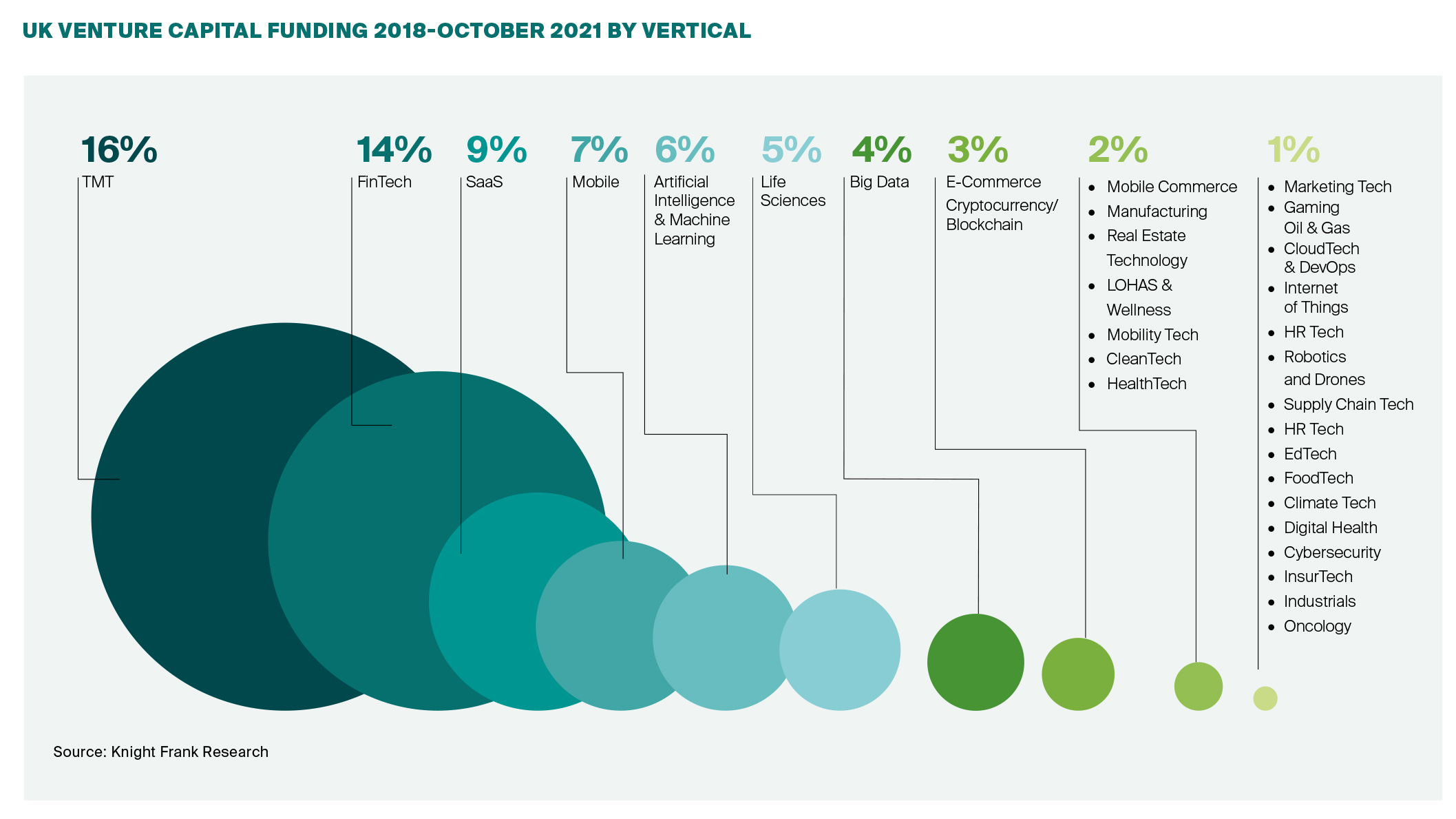

A detailed review of 25 local UK economic recovery plans reveals that life Sciences, Technology and Creative are the most referenced sectors in the identification of drivers of future economic and jobs growth. Life Sciences and Technology are also the highest ranking for UK enterprise R&D expenditure, value of venture capital funding and number of European patent applications. Advanced Manufacturing and Engineering, Automotive, Aerospace and Energy sectors also ranked well, albeit the impact of expansion of these sectors would influence not just demand for offices but many other real estate asset classes.

Thematic investment – where a range of companies who have traditionally been either direct competitors or operated in entirely different segments of the economy, have formally collaborated to tackle big challenges and themes – featured strongly.

Emerging themes include healthy ageing, smart cities, future mobility and the transition to net zero. Indeed, sectors relating to a carbon neutral and sustainable economy were referenced directly in the 25 economic recovery plans. From a real estate perspective, we are starting to see development of innovation clusters centered on these thematic areas. A good example can be drawn from Newcastle’s innovation district, which is tackling healthy ageing, being home to the National Innovation Centre for Ageing. SPARK in Cardiff illustrates this developing, with its focus on tackling societal challenges including decarbonisation.

New sectors, new business structure, new spaces?

In order to capture the opportunity and secure high-growth tenants from knowledge and innovation intensive sectors, there are some further considerations that the supply side will need to take into account. Companies specialising in Life Sciences for example gravitate towards developments that create, curate and cultivate a collaborative ecosystem either around specific themes, ideas or life sciences specialisms. These ecosystems are often anchored by universities, research institutions and increasingly research-intensive hospitals. Furthermore, the shift towards towards more computational research and development will see an increase in the need for more conventional office space in city centre locations. However, these offices will need to provide ultra-fast and high volume data connectivity as a pre-requisite.

The influence of technology is inescapable. The technology sector today seems to be a catch all term with multiple definitions. Its constitution varies but typically will include tech titans, tech derivations of traditional sectors, creative and sub-divisions of the pure IT sector. A fourth wave of technological innovation is creating new sub-sectors, with examples being artificial intelligence, quantum computing and augmented reality. The principal real estate considerations are broad and often bespoke, however, the central theme is flexibility in order to accommodate project teams, coupled with high performance and resilient digital connectivity capabilities to ensure speed and consistent service delivery.

What new sectors will emerge?

New sectors, economies and corporate collaborations are rapidly emerging to tackle today’s pressing social and environmental challenges. Greater awareness and investment is now targeting sectors relating to a carbon neutral and sustainable economy for example. This has the potential to underpin substantial jobs growth and, hence, new demand for office space. According to Bruntwood SciTech, the UK’s transition to Net Zero will create more jobs in the Science and Technology sector than any other industry, delivering 65% of all roles – or some 365,000 jobs – by 2050.

Furthermore, occupier demand will derive from companies across all sectors embedding ESG into their business strategies. This will lead to a major re-set of real estate portfolios. Organisations will target buildings that reflect and help achieve ESG ambitions as increasingly ESG is associated with brand values. Buildings with superior ESG credentials and a strong sense of purpose and community will therefore command a greater level of demand.

Concluding

Innovation and knowledge intensive sectors are becoming an increasingly important source of office demand across the UK cities markets. The supply-side is reactive and adapting to this new dynamic, with the creation of imaginative work spaces increasingly in the quest of capturing the next business of tomorrow. In practice this is meaning flexible, collaborative, amenity rich spaces with superior ESG credentials in locations that offer deep talent pools and strong connections to knowledge and research institutions. Business is changing at rapid pace, with advanced technology adoption at the heart of future competitiveness. The real estate of cities will need to stretch its horizons to stay relevant.

Download UK Cities 2022